Rational Tactical Return Fund:

With Rising Volatility Consider Adding Alternatives

With Rising Volatility Consider Adding Alternatives

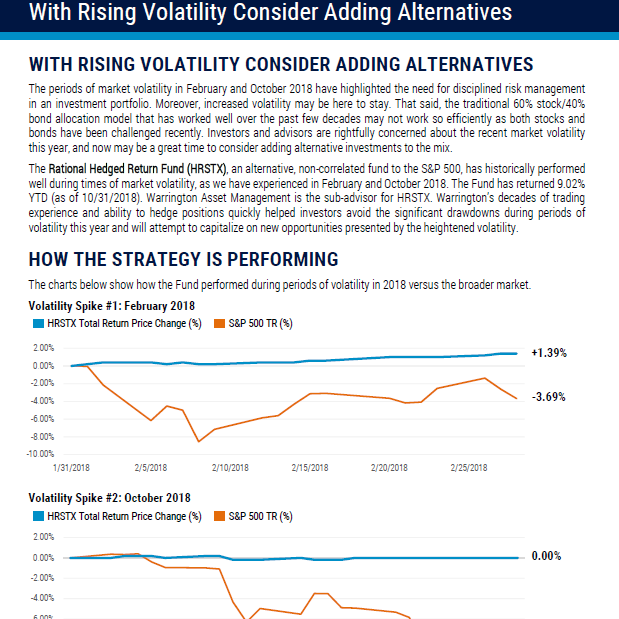

The periods of market volatility in 2018 and 2019 year to date have highlighted the need for risk management in an investment portfolio. Moreover, increased volatility may be here to stay. That said, the traditional 60 stock/ 40 bond allocation model that has worked well over the past few decades may not work so efficiently as both stocks and bonds have been challenged recently. Investors and advisors are rightfully concerned about the recent market volatility this year, and now may be a great time to consider adding alternative investments to the mix.

The Rational Tactical Return Fund (HRSTX), an alternative, non correlated fund to the S&P 500 has historically performed well during times of market volatility, as we experienced in 2018 and 2019. The Fund returned 9.66 in 2018. Warrington Asset Management is the sub advisor for HRSTX. Warrington’s decades of trading experience and ability to hedge positions quickly helped investors avoid the significant drawdowns during periods of volatility this year and will attempt to capitalize on new opportunities presented by the heightened volatility.

The Fund’s investment objective is to seek total return consisting of long-term capital appreciation and income.

How the Strategy is Performing

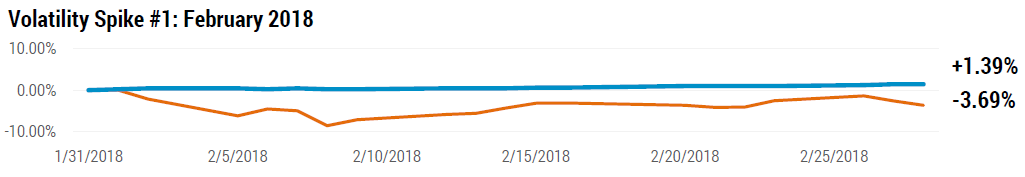

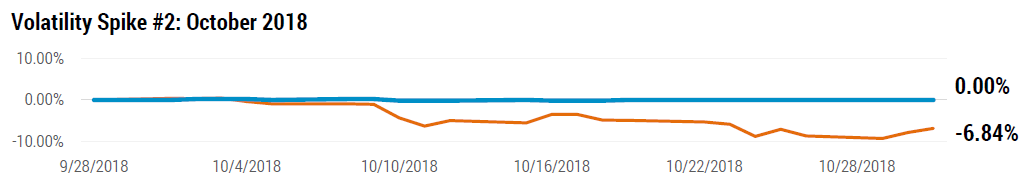

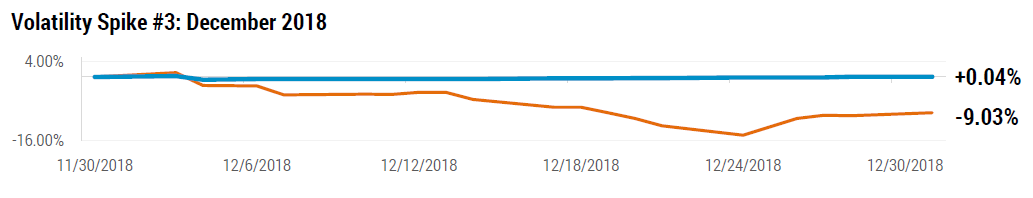

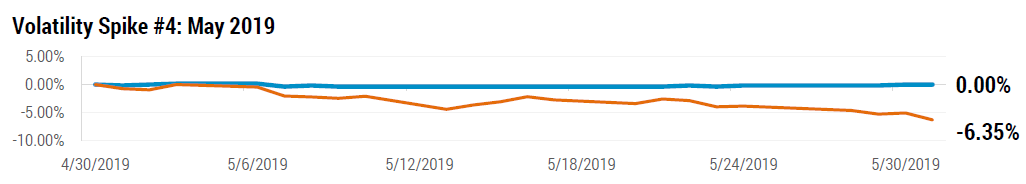

The charts below show how the Fund performed during periods of volatility in 2018 versus the broader market.

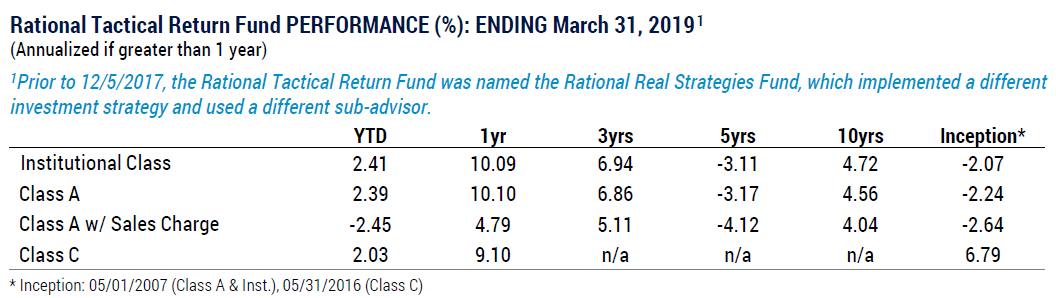

The maximum sales charge for Class “A” Shares is 4.75%. The Fund’s total annual fund operating expenses are 3.58%, 4.24%, and 3.24% for Class A, C, and I shares, respectively. Class “C” Shares held for less than one year are subject to a 1% CDSC. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month end performance information or the funds prospectus please call 800-253-0412 or visit www.RationalMF.com.

Important Risk Information

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund’s portfolio. There are risks associated with the sale and purchase of call and put options. As the buyer of a put option, the Fund assumes the risk of a rise in the market price of the underlying security above the exercise price of the option which will cause a loss of the premium paid for the option. As a seller (writer) of a put option, the Fund will lose money if the value of the security falls below the strike price. The Fund may experience losses that exceed those experienced by funds that do not use futures contracts, options and hedging strategies.

Download the Full Report

4773-NLD-6/19/2019