Rational Tactical Return Fund

Tickers: HRSAX | HRSFX | HRSTX

Fund Objective

The Fund’s investment objective is to seek total return consisting of long-term capital appreciation and income.

Reasons to Invest

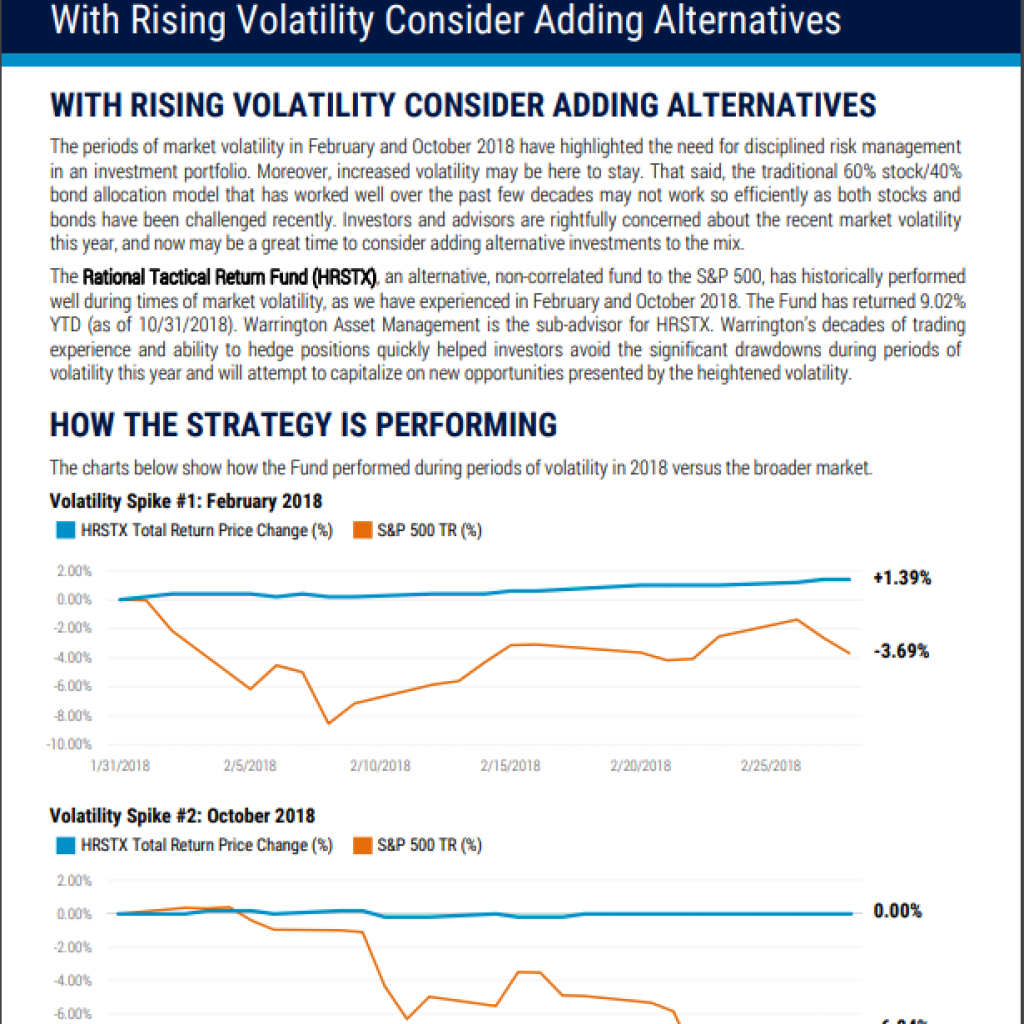

The Fund invests primarily in long and short call and put options on futures contracts on the S&P 500 Index and in cash, and cash equivalents. The Fund’s investment objective is to seek total return consisting of long-term capital appreciation and income. The Fund seeks to achieve its investment objective in three ways: (1) Premium Collection – the Fund collects premiums on options it sells; (2) Volatility Trading – the Fund may enter into positions designed to hedge or profit from either an increase or a decrease in Index volatility; and (3) Trend Following – the Fund may increase or decrease the balance of puts and calls based on trending market direction. The Fund is designed to produce returns that are not correlated with equity market returns. The Fund employs strict risk management procedures, supported by both technical and fundamental analysis, that is intended to provide consistency of returns and to mitigate the extent of losses.

Portfolio Manager Insights

Fund Management

Warrington Asset Management, an alternative asset manager founded by Scott C. Kimple in 1997, is the sub-advisor for HRSTX.

The sub-advisor, Warrington Asset Management, has a track record of only two down years in 22 among their strategies – winning the Pinnacle Award in 2017 & 2019 for the best five-year option strategy.

This alternative investment strategy focuses on trading options on S&P 500 Index Futures, and has a 20+ year track record delivering consistent, noncorrelated returns with a strong focus on risk management. Prior to January of 2015, Warrington was an independent but affiliated group within Morgan Stanley (and predecessor firms) and only available to their customers. Warrington is registered with the CFTC as a CPO and CTA, and as an investment advisor with the SEC. Warrington is also a member of the NFA.

Scott C. Kimple

Founder, Principal & Portfolio Manager for Warrington Asset Management

Mark W. Adams

Assistant Portfolio Manager and Chief Quantitative Officer for Warrington GP

Fund Overview

Data as of: 2024-08-20T00:00:00

| Ticker | HRSAX | HRSFX | HRSTX | HRSAX |

| Share Class | Class A | Class C | Class I | Class A w/ Sales Load |

| CUSIP | 628255606 | 628255770 | 628255705 | 628255606 |

| Inception Date | 2007-05-01T00:00:00 | 2016-05-31T00:00:00 | 2007-05-01T00:00:00 | 2007-05-01T00:00:00 |

| As of Date | 2025-08-07T00:00:00 | 2025-08-07T00:00:00 | 2024-08-20T00:00:00 | 2025-08-07T00:00:00 |

| Daily NAV | 17.05 | 16.31 | 17.2 | 17.05 |

| NAV Change | 0.01 | 0 | 0 | 0.01 |

| % NAV Change | 0.06% | 0.00% | 0.00% | 0.06% |

Current Fund Performance

Data as of: 2024-08-20T00:00:00

Prior to 12/5/2017, the Rational Tactical Return Fund was named the Rational Real Strategies Fund, which implemented a different investment strategy and used a different sub-advisor.

| Share Class | 1 Month | 3 Months | 6 Months | YTD | 1 Year | 3 Years Annualized | 5 Years Annualized | 10 Years Annualized | Since Inception Annualized |

| Class A | -0.18% | 0.65% | 1.49% | 1.79% | 3.44% | 3.28% | 2.64% | 3.37% | -0.36% |

| Class C | -0.24% | 0.49% | 1.12% | 1.30% | 2.64% | 2.50% | 1.88% | N/A | 3.78% |

| Class I | -0.52% | 0.12% | 1.18% | 1.71% | 3.63% | 2.45% | 3.10% | 0.12% | -0.38% |

| Class A w/Sales Load | -4.91% | -4.11% | -3.34% | -3.07% | -1.50% | 1.61% | 1.65% | 2.87% | -0.63% |

Quarterly Fund Performance

Data as of Quarter End: 2024-06-30T00:00:00

| Share Class | 1 Month | 3 Months | 6 Months | YTD | 1 Year | 3 Years Annualized | 5 Years Annualized | 10 Years Annualized | Since Inception Annualized |

| Class A | 0.47% | 1.25% | 1.91% | 1.91% | 2.96% | 3.34% | 2.77% | 2.91% | -0.36% |

| Class C | 0.43% | 1.11% | 1.55% | 1.55% | 2.21% | 2.56% | 2.00% | N/A | 3.86% |

| Class I | 0.35% | 1.05% | 2.07% | 2.07% | 5.07% | 2.74% | 3.35% | -0.22% | -0.36% |

| Class A w/Sales Load | -4.32% | -3.56% | -2.96% | -2.96% | -1.93% | 1.67% | 1.78% | 2.41% | -0.62% |

The maximum sales charge for Class “A” Shares is 4.75%. Class “C” Shares held for less than one year are subject to a 1% CDSC. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month end performance information or the Funds prospectus please call 800-253-0412 or visit www.RationalMF.com.

Fund Expenses

Data as of: 2024-08-20T00:00:00

| Share Class | Class I | Class A | Class C | Class A w/ Sales Load |

| Prospectus Gross Expense Ratio (May 1, 2025) | 2.21% | 2.49% | 3.15% | 2.49% |

| Prospectus Net Expense Ratio* (May 1, 2025) | 2.07% | 2.32% | 3.07% | 2.32% |

*Rational Advisors, Inc. (the “Advisor”) has contractually agreed to waive all or a portion of its management fee and/or reimburse certain operating expenses of the Fund to the extent necessary in order to limit the Fund’s total annual fund operating expenses (excluding (i) acquired fund fees and expenses; (ii) brokerage commissions and trading costs; (iii) interest (including borrowing costs and overdraft charges), (iv) taxes, (v) short sale dividends and interest expenses, and (vi) non-routine or extraordinary expenses, such as regulatory inquiry and litigation expenses) to not more than 1.99%, 2.24% and 2.99% of the average daily net assets of the Fund’s Institutional, Class A, and Class C shares, respectively, through April 30, 2026.

Past performance is not a guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Rational Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (800) 253-0412 or at www.RationalMF.com. The prospectus should be read carefully before investing. The Rational Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Rational Advisors, Inc. is not affiliated with Northern Lights Distributors, LLC.

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund’s portfolio. There are risks associated with the sale and purchase of call and put options. As the buyer of a put option, the Fund assumes the risk of a rise in the market price of the underlying security above the exercise price of the option, which will cause a loss of the premium paid for the option. As a seller (writer) of a put option, the Fund will lose money if the value of the security falls below the strike price. The Fund may experience losses that exceed those experienced by funds that do not use futures contracts, options and hedging strategies.

Awards Methodology

All funds reporting to Allocator.com are considered for the awards.

There are two types of awards:

- The Top Performer Awards — these are granted to the select few funds, which have outperformed their wider peer group in each category. Winners are determined purely based on quantitative risk adjusted returns. For 2020 we have extended the time period under consideration to evaluate how managers navigated both 2019 and the Covid-19 related market turbulence in early 2020. The 2020 Top Performer award winners will be chosen based on absolute returns from January 1, 2019 to April 30, 2020. The Long-Term categories consider returns from January 2017 to April 2020.

- The Investors Choice’ Awards —For each category, the fund, which receives the highest qualitative scoring by the judges receives the prestigious award. Institutional investors from around the world score the Top Performers on a range of qualitative criteria including investment processes, risk framework, transparency, team, and ability to generate alpha. The judges review manager profiles on the Allocator.com portal and independently assign a score from 1 to 10 in each of the qualitative assessment areas for each fund.

4780-NLD-7/27/2020