Why You Should Allocate to Senior Mortgage Bonds for Adverse Fixed Income Environments

RFXIX has outperformed during this adverse fixed income environment because of its focus on floating rate bonds backed by mortgages that typically have 50% or higher homeowner equity.

By Michael Schoonover | October 17, 2022

2022 is set to be the worst year on record for bonds, based on the history of the Bloomberg Aggregate Bond Index going back to the 1970’s. This has dealt a blow to many portfolios relying on a bond allocation for income and/or to offset losses from equities. Interest rates today are still far below long-term historical averages and there are no signs of easing inflation, implying more downside ahead for traditional fixed income investments.

Despite the negative outlook, investors have options. Senior mortgage bonds, particularly seasoned bonds backed by mortgages issued more than 15 years ago, offer a compelling option to mitigate the risk of today’s fixed income markets. The combination of floating rate features and mortgages with 50% or higher homeowner equity tends to mitigate the two factors significantly impacting traditional bonds today: interest rate risk and credit risk. Allocating to a senior mortgage bond strategy, like the Rational Special Situations Income Fund (RFXIX), can position investors for meaningful yield and outperformance in adverse fixed income environments.

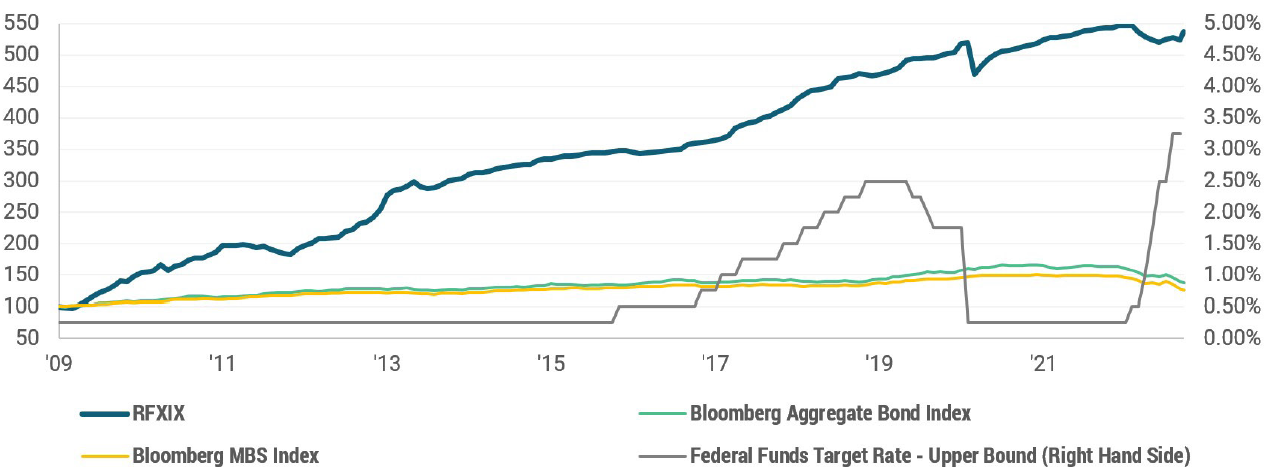

RFXIX has outperformed the traditional fixed income benchmarks since 2009.

Source: Rational Advisors, Inc. and Bloomberg LP. Data as of 10/17/2022.

Past performance is not indicative of future results.

In an environment with limited options, senior mortgage bond strategies

like RFXIX offer a compelling option for meaningful yield and outperformance.

like RFXIX offer a compelling option for meaningful yield and outperformance.

Here are three reasons why investors have been reallocating from their traditional fixed income exposure to RFXIX.

1.

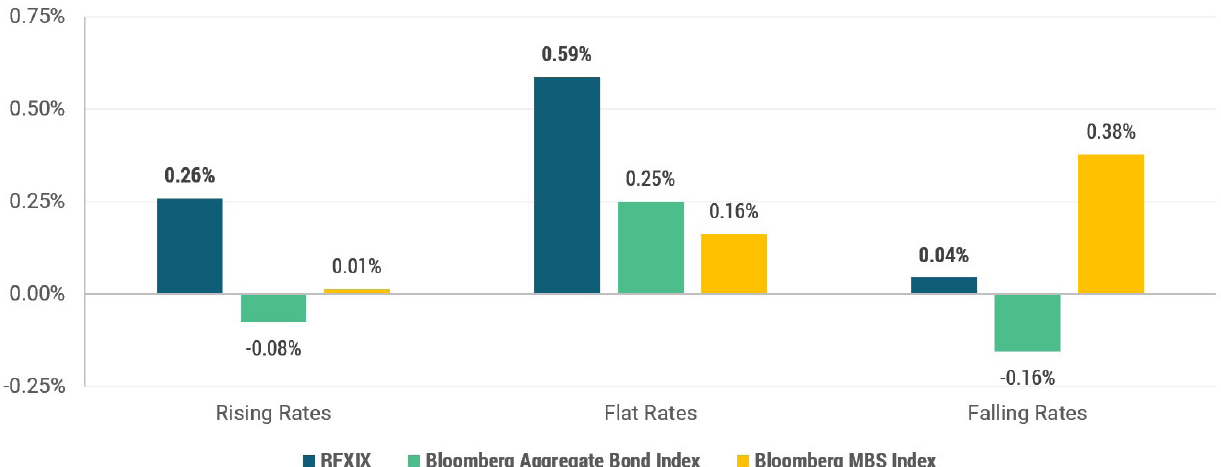

RFXIX HAS PERFORMED WELL IN VARIOUS RATE ENVIRONMENTS.

While interest rate risk and credit risk impact the prices of senior mortgage bonds, there are various other factors at play (e.g., housing market strength) that make the bonds more dynamic than many corporate bonds or government bonds. In fact, since inception in 2009, RFXIX has generated a positive median return in all interest rate environments.

RFXIX HAS GENERATED POSITIVE MEDIAN RETURNS IN VARIOUS INTEREST RATE ENVIRONMENTS.

Source: Rational Advisors, Inc. and Bloomberg LP. Data as of 10/17/2022. Interest rate environment determined by Federal Funds Target Rate Upper Bound change during calendar month. Rising rates: 25 bps or more increase during month; Flat rates: no change; Falling rates: 25 bps or more decrease during month. Median return used to reduce the impact of outlier months, including March 2020.

Past performance is not indicative of future results.

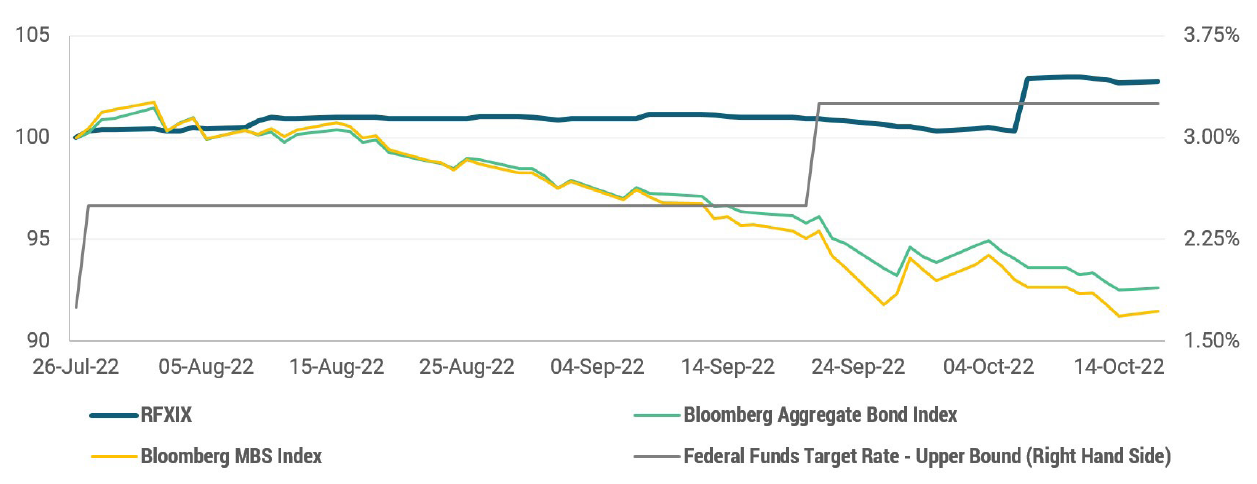

In July 2022, the Federal Reserve (the “Fed”) raised interest rates by 75 bps to a target upper bound of 2.50%, a level last seen in December 2018, corresponding to the intra-year bear market in equities. As traditional bonds collapsed, RFXIX generated positive returns and continued to do so even as the Fed raised rates an additional 75 bps to 3.25%, a level not seen since March of 2008. By primarily investing in floating rate bonds, RFXIX was positioned to mitigate the impact that rising interest rates had on traditional, fixed rate bonds.

RFXIX DELIVERED POSITIVE RETURNS AS TRADITIONAL BONDS COLLAPSED FOLLOWING THE TRANSITION TO A RATE ENVIRONMENT NOT SEEN SINCE MARCH OF 2008.

Source: Rational Advisors, Inc. and Bloomberg LP. Data as of 10/17/2022.

Past performance is not indicative of future results.

2.

RFXIX INVESTS IN BONDS BACKED BY MORTGAGES WITH SIGNIFICANT HOMEOWNER EQUITY.

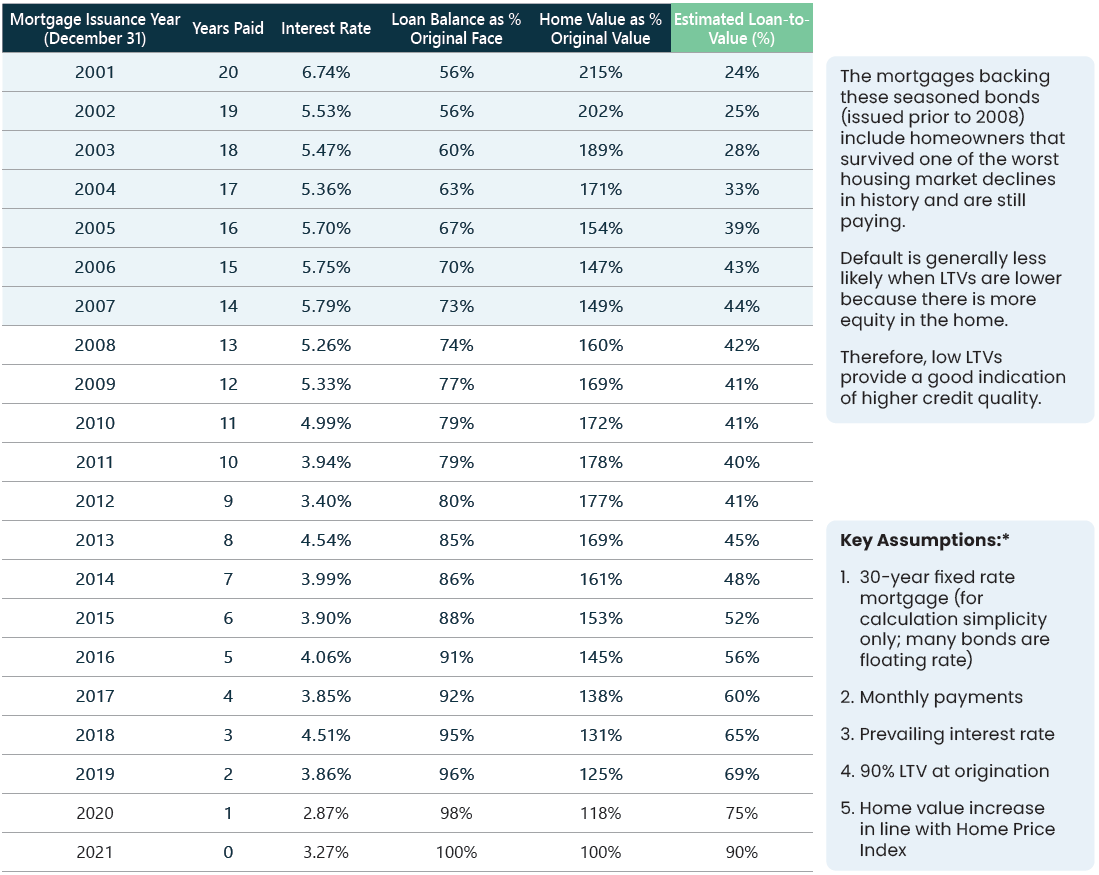

Seasoned, senior mortgage bonds in which RFXIX focuses are backed by mortgages issued prior to 2008. Not only did the homeowners of these mortgages survived the financial crisis, but they are also still paying today and generally have 50% or more homeowner equity now. This significantly diminishes the credit risk in these senior bonds. If the underlying borrower runs into financial trouble, he can typically sell his house for more than the balance of the mortgage, and even if he doesn’t sell and defaults, the bank is in a strong position to recoup the balance due given that the mortgage is roughly only 50% of the home value.

SEASONED, SENIOR MORTGAGE BONDS TEND TO HAVE HIGH HOMEOWNER EQUITY WHICH SIGNIFICANTLY REDUCES THE CREDIT RISK OF THE BONDS.

Legacy (Pre-2008) RMBS Tend to Exhibit More Favorable LTVs.

Hypothetical Mortgage Loan-to-Value (LTV) as of December 31 2021 Based on Market Index Data

Hypothetical Mortgage Loan-to-Value (LTV) as of December 31 2021 Based on Market Index Data

Source: Rational Advisors, Inc. and Bloomberg LP. Data as of 12/31/2021.

*These assumptions are used to present how LTVs improve with improving housing fundamentals and bond seasoning and do not represent any actual LTVs.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

3.

RFXIX PROVIDES EXPOSURE TO INVESTMENTS WITH ASYMMETRIC UPSIDE RETURN POTENTIAL.

A unique feature of RFXIX is that the portfolio managers seek out special situations investments that offer asymmetric upside return potential, meaning that a successful investment could lead to excess positive returns while an unsuccessful investment would be expected to exhibit the typical asset class returns. The mortgage bond asset class offers this potential because the legal documents of these bonds are hundreds of pages and hardly any market participants spend the time or have the expertise to read through these and identify opportunities.

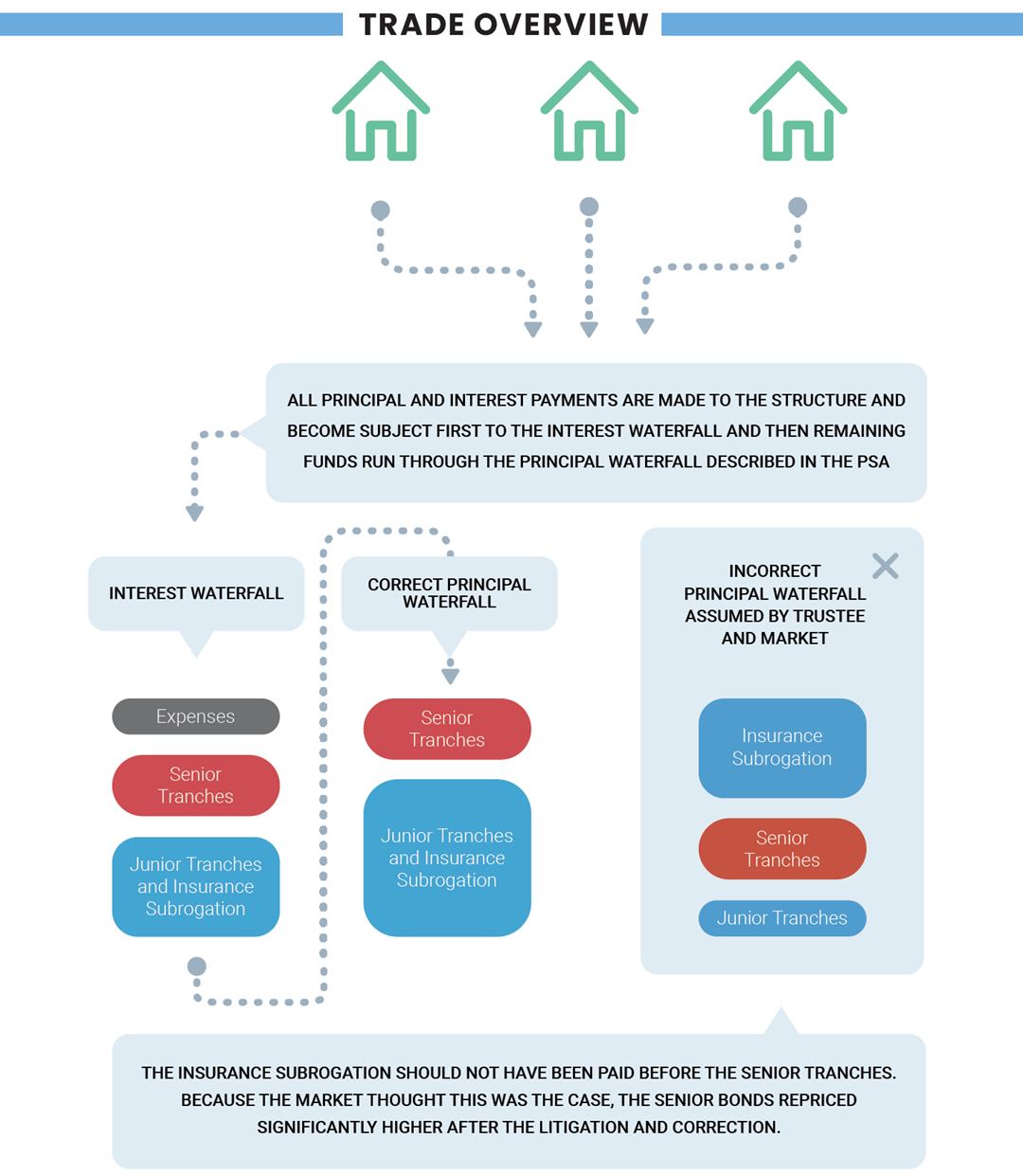

One example of this is where portfolio managers identified a bond where the servicer was not correctly interpreting the payout. In this case, the servicer was paying the principal on the bonds to an insurance company before the senior bondholders. It was paying the insurance company for losses the insurance company had previously paid out on mezzanine bonds. Insurance recovery rights are called rights of subrogation. RFXIX bought the senior bonds and challenged the servicer.

After successfully litigating, the servicer corrected the cash waterfall to pay the senior bondholders prior to the insurance subrogation. During the litigation, the servicer had not made any payouts to either party but held the payments in escrow until the court determined who and how they should pay out. Once the market realized the new cashflow structure, the price of the senior bonds increased substantially. The actual outcome was +158% on the trade, after the price appreciation of the bonds and the legal expenses. Had the portfolio managers been wrong, it was likely that no incremental losses would have incurred because the litigation was never priced into the bonds by the market

Integrating RFXIX Into A Portfolio

As discussed, it is our belief that RFXIX is well positioned to provide meaningful yield and outperformance relative to traditional fixed income during various environments. For this reason, we see this Fund as a strong fit as a core fixed income allocation in an investor’s portfolio. The uncorrelated nature of the Fund and its consistent strong returns can also make it versatile enough to replace other underperforming investments in this tough market environment.

Shift Allocations to Senior Floating Rate Mortgage

Bonds for Rising Rate Environments.

Bonds for Rising Rate Environments.

RFXIX has a history of outperformance during adverse fixed income periods in part by utilizing its focus on floating rate bonds backed by mortgages that typically have 50% or higher homeowner equity.

About the Author

Michael Schoonover is Chief Operating Officer of Catalyst Capital Advisors LLC and Rational Advisors, Inc. He began his association with Catalyst in 2011 as a research consultant supporting the implementation and back testing of quantitative strategies. In March 2013, he became a senior analyst at Catalyst to provide investment research for several mutual funds. From 2005-2011, he served in various technical and scientific management roles with the Perrigo Company. Mr. Schoonover has an MBA with high distinction from the University of Michigan Ross School of Business and a BS from the University of Michigan.

Performance (%): Ending September 30, 2022

Annualized if greater than a year

| Share Class/Benchmark | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception* |

| Class I | -3.20 | 1.88 | 5.43 | 8.50 | 12.90 |

| Bloomberg US Agg TR Index | -14.60 | -3.26 | -0.27 | 0.89 | 2.47 |

| Bloomberg MBS TR Index | -13.98 | -3.67 | -0.92 | 0.51 | 1.82 |

| Class A | -3.44 | 1.65 | 5.17 | 8.23 | 12.63 |

| Class C | -4.16 | 0.89 | 4.37 | 7.42 | 11.79 |

| Class A w/Sales Charge | -8.05 | 0.00 | 4.16 | 7.70 | 12.22 |

*Inception: 02/01/2009. The performance shown prior to July 17, 2019 is that of the Predecessor Fund, which reflects all of the

Predecessor Fund’s actual fees and expenses adjusted to include any fees of each share class.

Maximum sales charge for Class A is 4.75%. Maximum Deferred Sales Charge of 1.00% on Class C Shares applies to shares sold within 12 months of purchase. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Results shown reflect the waiver, without which the results could have been lower. A fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. To obtain the most recent month end performance information or the Fund’s prospectus please call 800-253-0412 or visit www.rationalmf.com.

There is no assurance that the Fund will achieve its investment objective. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. Gross expense ratios for share classes A, C, and I are 2.04%, 2.75%, and 1.78%, respectively.

Past performance is not a guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Rational Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (800) 253-0412 or at www.rationalmf.com. The prospectus should be read carefully before investing. The Rational Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Rational Advisors, Inc. is not affiliated with Northern Lights Distributors, LLC.

Risk Considerations:

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund’s portfolio. Investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategies. The Fund is non-diversified and may invest a greater percentage of its assets in a particular issue and may own fewer securities than other mutual funds; the Fund is subject to concentration risk. When the Fund invests in asset-backed securities and mortgage-backed securities, the Fund is subject to the risk that, if the underlying borrowers fail to pay interest or repay principal, the assets backing these securities may not be sufficient to support payments on the securities. Interest rate risk is the risk that bond prices overall, including the prices of securities held by the Fund, will decline over short or even long periods of time due to rising interest rates. Bonds with longer maturities tend to be more sensitive to interest rates than bonds with shorter maturities. Lower-quality bonds, known as “high yield” or “junk” bonds, present greater risk than bonds of higher quality, including an increased

risk of default. Credit risk is the risk that the issuer of a security will not be able to make principal and interest payments when due. These factors may affect the value of your investment.

The Fund commenced operations by acquiring all of the assets and liabilities of ESM Fund I, L.P. (the “Predecessor Fund”) in a tax-free reorganization on July 17, 2019 (the “Reorganization”). In connection with the Reorganization, investors in the Predecessor Fund received Institutional Shares of the Fund. The Fund’s investment objectives, policies, guidelines and restrictions are, in all material respects, equivalent to those of the Predecessor Fund. However, the Predecessor Fund was not registered under the 1940 Act and, therefore, was not subject to certain investment restrictions, limitations and diversification requirements that are imposed by the 1940 Act or Subchapter M of the Internal Revenue Code, which, if they had been applicable, might have adversely affected the Predecessor Fund’s performance. The Fund’s Sub-Advisor was the investment adviser to the Predecessor Fund. The Fund’s fees and expenses are expected to be higher than those of the Predecessor Fund, so if the Fund’s expenses were applied to the Predecessor Fund’s performance, the performance would have been lower.

8216-NLD-11012022

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.