Why Now is the Time to Consider the Rational Special Situations Income Fund (RFXIX) for Your Investment Portfolio

The portfolio management team at ESM Management is optimistic about 2024. Here’s why we believe you should consider RFXIX.

In a prior piece, we wrote about how Dr. Eric S. Meyer, Founder of ESM Management, went from Harvard-educated physicist to investment manager (and lawyer), bringing the Rational Special Situations Income Fund (RFXIX) recognition and a 12.30% annualized return (as of December 31, 2023). Today, we wanted to share why he and his team see the current opportunity set in their investment universe as ripe for growth.

Three Reasons to Invest in RFXIX in the Current Market Environment:

- When interest rates on Treasuries and other bonds fell in 2023, Mortgage Backed Securities (MBS) yields did not move much. This means that on a relative basis, we see MBS as even more attractive than before.

- The team is seeing about 7.5% yields in the senior Non-Agency Residential Mortgage-Backed Securities (NARMBS) space and between 9% and 11% yields for senior Commercial Mortgage-Backed Securities (CMBS).

- In terms of our special situations opportunity set, we are finding many opportunities and remain optimistic that this can continue. This aspect of the portfolio, combined with a philosophy of potentially limiting interest rate and credit risk lead to a low correlation with traditional fixed income funds.

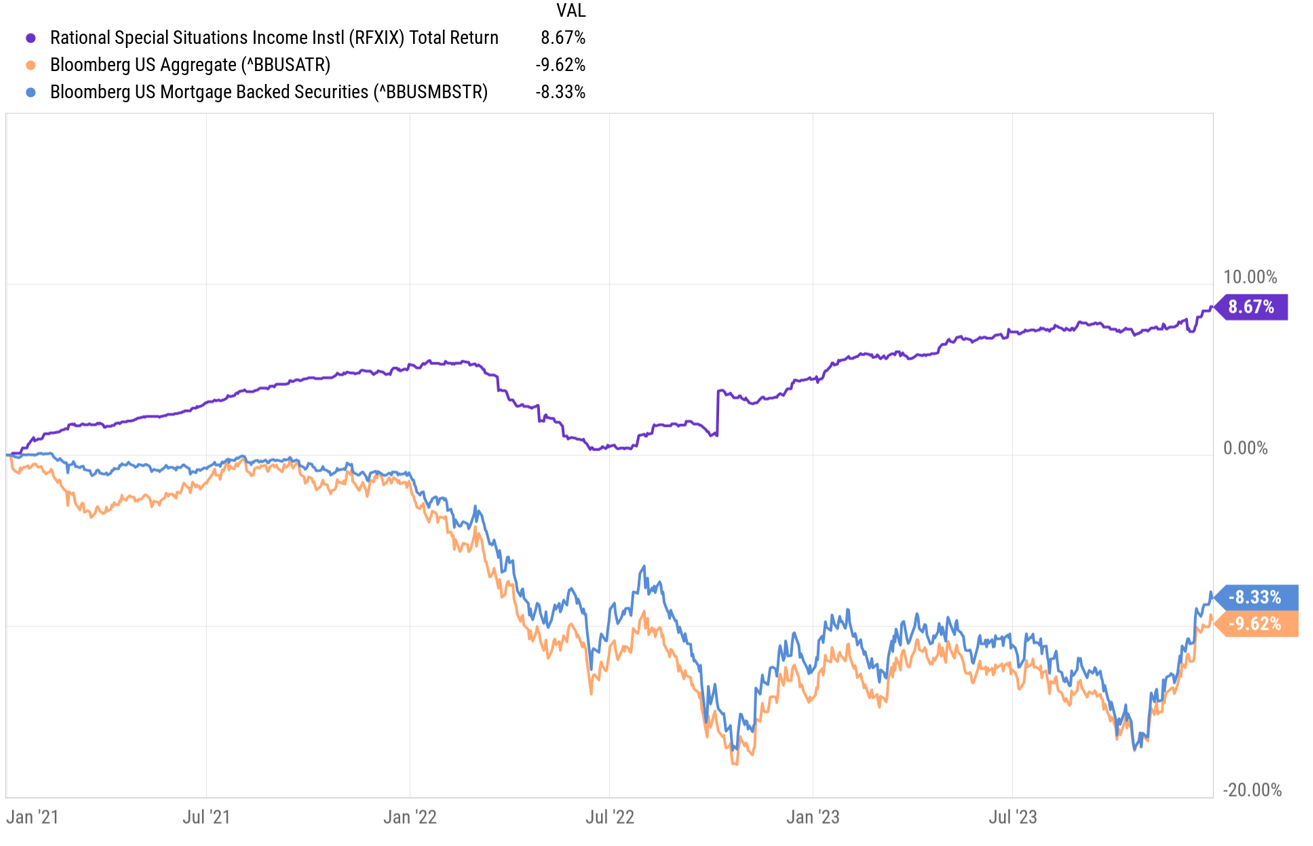

RFXIX Has Outperformed Traditional Fixed Income Benchmarks and is a Compelling Component For a Balanced Fixed Income Portfolio

RFXIX Vs. Bloomberg Agg Vs. Bloomberg MBS Index

Three Year Period Ending December 31, 2023

Three Year Period Ending December 31, 2023

Source: YCharts. Period shown reflective of December 31, 2020 – December 31, 2023. Past performance is no guarantee of future results. The y-axis shows total returns of the fund in the given period.

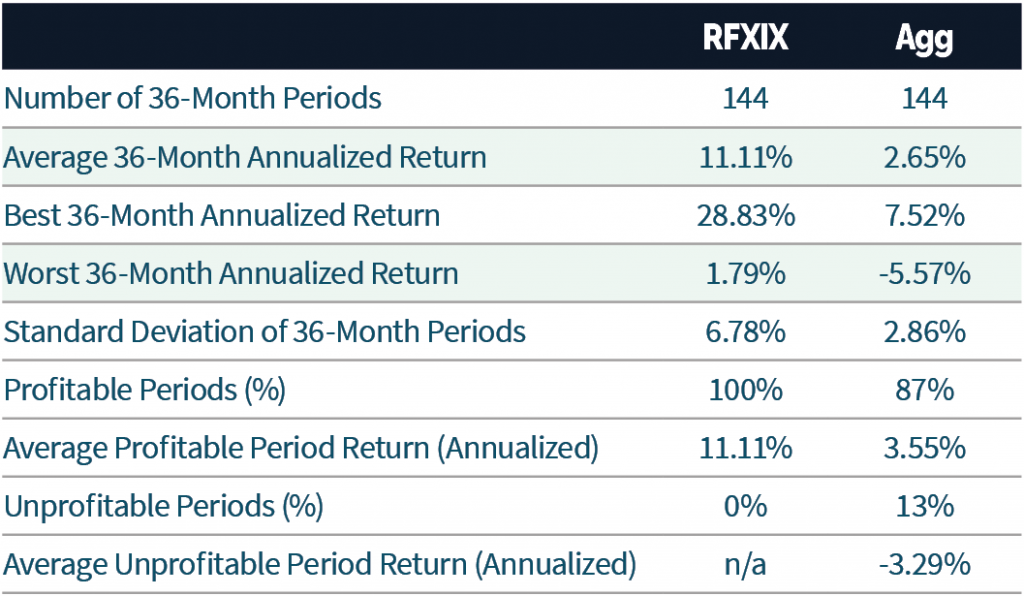

Rolling 3-Year Return Analysis (Feb 2009 – December 2023)

“We are optimistic for 2024. we believe Non-agency RMBS continue to offer attractive loss-adjusted yields, we’re finding special situations abound in both RMBS and CMBS, and we are excited about the special situations we already hold.”

– ESM Management

– ESM Management

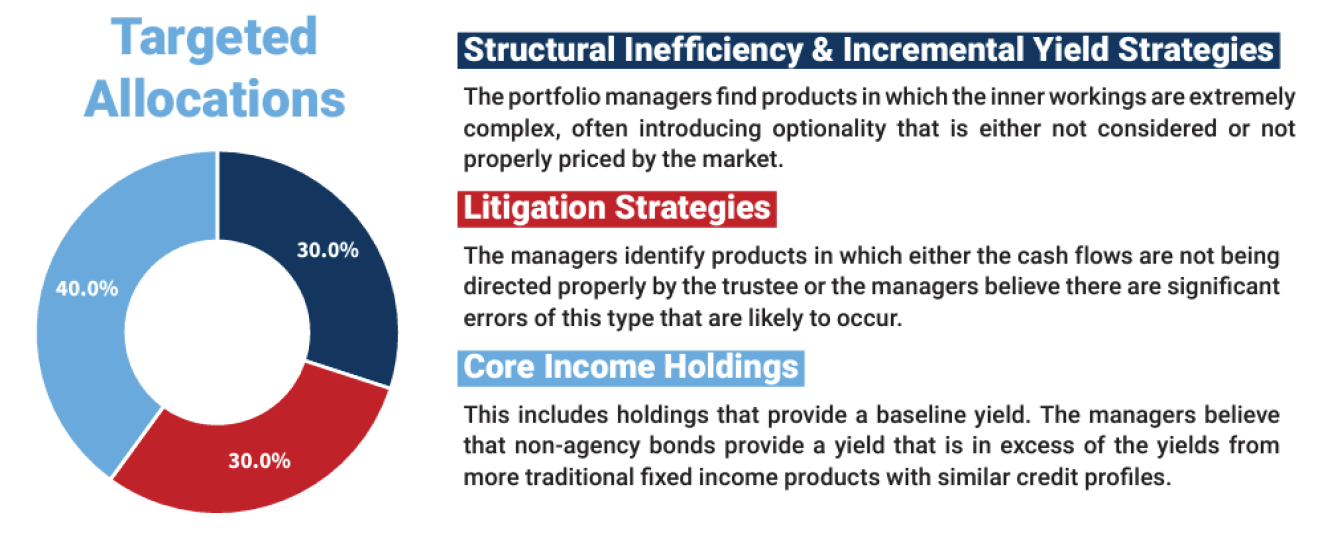

How RFXIX Invests

For those new to the Fund, special situation positions are typically of that nature that the market has not priced in upside scenarios ESM has identified; thus creating an opportunity where the downside is limited to market yield shifts. The result is typically an asymmetric outcome where “heads we win, tails we break even”.

In evaluating the investment universe, the team focuses on senior tranches of debt – which is an effort to potentially minimize credit and interest rate risk and lower volatility.

About the Author

Data as of Quarter End: 2025-06-30T00:00:00

Annualized if greater than a year

| Share Class | 1 Month | 3 Months | 6 Months | YTD | 1 Year | 3 Years Annualized | 5 Years Annualized | 10 Years Annualized | Since Inception Annualized |

| Class A | 0.46% | 0.52% | 2.28% | 2.28% | 5.84% | 6.21% | 4.39% | 6.00% | 11.59% |

| Class C | 0.40% | 0.33% | 1.92% | 1.92% | 5.02% | 5.42% | 3.61% | 5.21% | 10.76% |

| Class I | 0.46% | 1.57% | 5.15% | 5.15% | 6.59% | 3.50% | 3.70% | 6.31% | 12.25% |

| Class A w/Sales Load | -4.33% | -4.23% | -2.58% | -2.58% | 0.81% | 4.50% | 3.38% | 5.48% | 11.26% |

*Inception: 02/01/2009. The performance shown prior to July 17, 2019 is that of the Predecessor Fund, which reflects all of the

Predecessor Fund’s actual fees and expenses adjusted to include any fees of each share class.

The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free 646-827-2761.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Rational Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (800) 253-0412 or at www.rationalmf.com. The prospectus should be read carefully before investing. The Rational Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Rational Advisors, Inc. and ESM Management are not affiliated with Northern Lights Distributors, LLC.

Important Risk Considerations:

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund’s portfolio. Investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategies. The Fund is non-diversified and may invest a greater percentage of its assets in a particular issue and may own fewer securities than other mutual funds; the Fund is subject to concentration risk. When the Fund invests in asset-backed securities and mortgage-backed securities, the Fund is subject to the risk that, if the underlying borrowers fail to pay interest or repay principal, the assets backing these securities may not be sufficient to support payments on the securities. Interest rate risk is the risk that bond prices overall, including the prices of securities held by the Fund, will decline over short or even long periods of time due to rising interest rates. Bonds with longer maturities tend to be more sensitive to interest rates than bonds with shorter maturities. Lower-quality bonds, known as “high yield” or “junk” bonds, present greater risk than bonds of higher quality, including an increased risk of default. Credit risk is the risk that the issuer of a security will not be able to make principal and interest payments when due. These factors may affect the value of your investment.

The Fund commenced operations by acquiring all of the assets and liabilities of ESM Fund I, L.P. (the “Predecessor Fund”) in a taxfree reorganization on July 17, 2019 (the “Reorganization”). In connection with the Reorganization, investors in the Predecessor Fund received Institutional Shares of the Fund. The Fund’s investment objectives, policies, guidelines and restrictions are, in all material respects, equivalent to those of the Predecessor Fund. However, the Predecessor Fund was not registered under the 1940 Act and, therefore, was not subject to certain investment restrictions, limitations and diversification requirements that are imposed by the 1940 Act or Subchapter M of the Internal Revenue Code, which, if they had been applicable, might have adversely affected the Predecessor Fund’s performance. The Fund’s Sub-Advisor was the investment adviser to the Predecessor Fund. The Fund’s fees and expenses are expected to be higher than those of the Predecessor Fund, so if the Fund’s expenses were applied to the Predecessor Fund’s performance, the performance would have been lower.

Glossary:

Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them.

Non-agency commercial mortgage-backed securities (NARMBS) are issued by banks and private lenders and are not backed by the U.S. government.

Commercial mortgage-backed securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. The standard deviation is calculated as the square root of variance by determining each data point’s deviation relative to the mean.

A special situation is an unusual event that compels investors to buy a stock or other asset in the belief that its price will rise.

Volatility is how much and how quickly prices move over a given span of time.

Senior tranches typically contain assets with higher credit ratings than junior tranches. Tranches are segments created from a pool of securities. The senior tranches have first lien on the assets—they’re in line to be repaid first, in case of default.

5199-NLD-3/12/2024

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.