Three Reasons to Allocate to an Alternative Hedged Equity Fund in the Current Market Environment

HDCTX has historically outperformed during periods of high market volatility while still managing to participate in market upside via a distinct stock picking strategy.

By Joe Tigay | February 6, 2023

Equity markets saw a difficult 2022, leading many investment portfolios derailed. With inflation continuing to climb, the volatility that drove the dismal returns seen in equity markets is likely to remain in 2023. The potential for continued equity losses has forced many investors to re-think their portfolio strategies.

One possible non-traditional alternative approach investors are considering is our large cap equity fund that invests in volatility instruments as a hedge. The Chicago Board Options Exchange Volatility Index (VIX) is a real-time index representing market expectations for volatility. The Miami Exchange SPIKES is a measure of the expected 30-day volatility in the SPDR S&P ETF (SPY). Both the VIX & SPIKES have an estimated negative beta correlation of -0.77 to the market. This means that, on a daily basis, there is a high probability that these volatility instruments will act as a hedge against the market. Allocating to a large cap value equity fund that invests in the Volatility, like the Rational Equity Armor Fund (HDCTX), can allow investors to mitigate downside risk while participating in market upside.

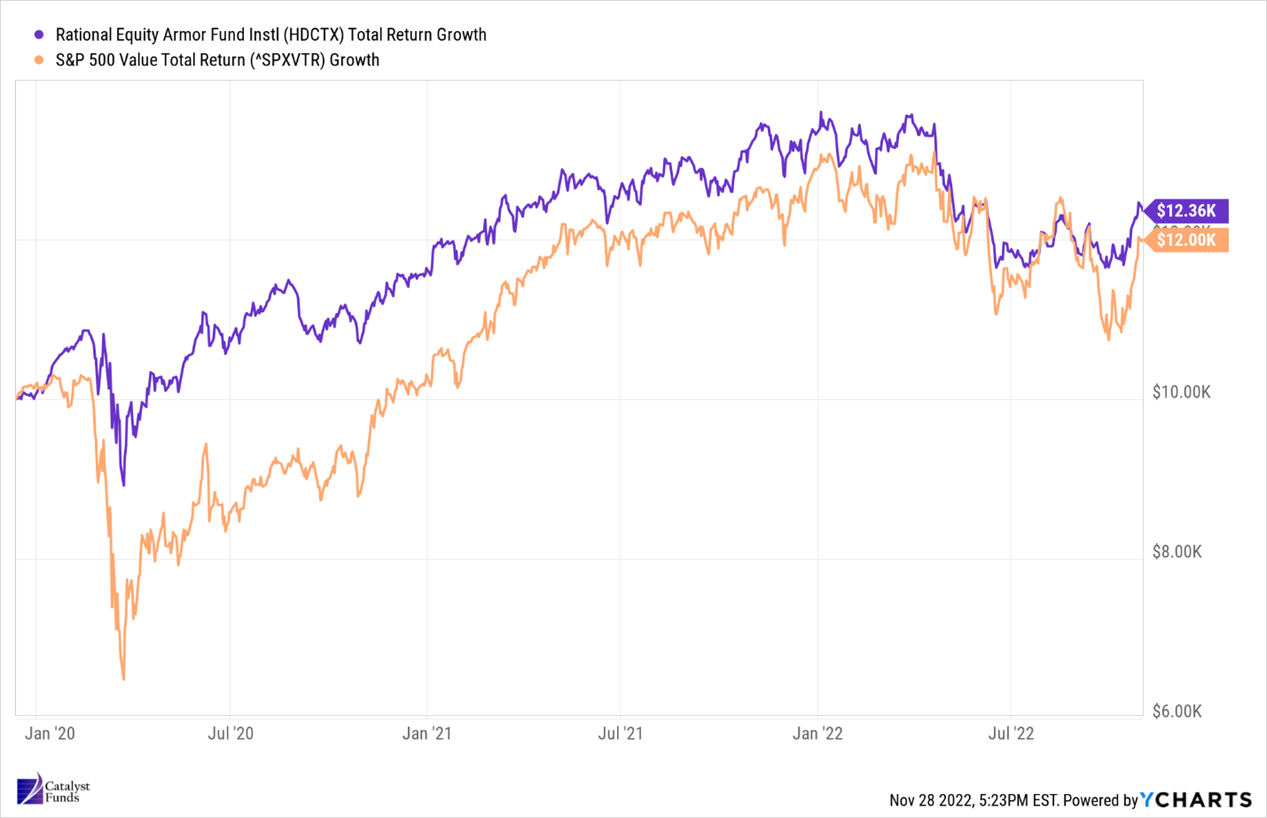

Since the current management team at Equity Armor Investments took over operations of HDCTX in December of 2019, the Fund has consistently managed volatility while providing upside to investors.

HDCTX Has Outperformed its Benchmark Since Management Takeover While Minimizing Volatility

Source: Source: Ycharts. Performance from 12/13/2019 to 11/1/2022.

Past performance is not indicative of future results.

In this piece, we include three reasons why we believe investors should reallocate a portion of their equity exposure to HDCTX:

1.

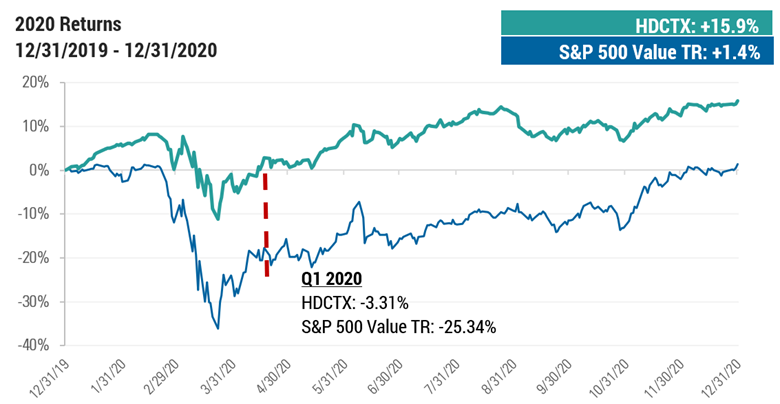

1. HDCTX Has Performed Well During Periods of High Market Volatility

A hedged equity approach like the one taken by HDCTX has managed to lessen the impact of high volatility in the past. The graph below illustrates HDCTX’s record of mitigating volatility during the S&P 500 Value’s worst drawdown since 2008, which occurred in 2020:

Source: Source: Equity Armor Investments.

Past performance is not indicative of future results.

HDCTX hedges against the equity sleeve of its portfolio by investing in volatility products such as VIX and SPIKES. By investing in volatility, the managers of HDCTX can provide diversification outside of traditional asset classes and minimize any potential equity losses.

While some other hedged equity funds also invest in volatility, the experience offered by our management team with the Volatility Index is nearly unmatched. Equity Armor Investments were early adapters to VIX trading when it emerged in 2007. Since then, our team has been involved in trading VIX & volatility instruments, learning how the Volatility Index responds to different market conditions and environments.

2.

HDCTX Can Participate in Market Upswing

Unlike some hedged equity funds, which can only mitigate losses due to volatility, HDCTX can actively engage in market upswings. HDCTX can do this via its distinct stock picking portfolio strategy, which invests in common stock of companies that are well suited for the current macro environment.

The model that the Fund uses to pick stocks will invest in companies that the team believes provides long-term growth potential and can take advantage of the characteristics of current market conditions. It uses proprietary screens and filters to select the common stock of qualified companies. The portfolio managers of HDCTX then review these stocks to select the final lineup of companies for the Fund’s portfolio. However, as part of the Fund’s keen risk management process, the portfolio managers will avoid putting outsized risk on any one sector, even if the model suggests this approach. This active process allows the managers to take advantage of growth opportunities while ensuring that investors aren’t exposed to significant risk in individual sectors.

3.

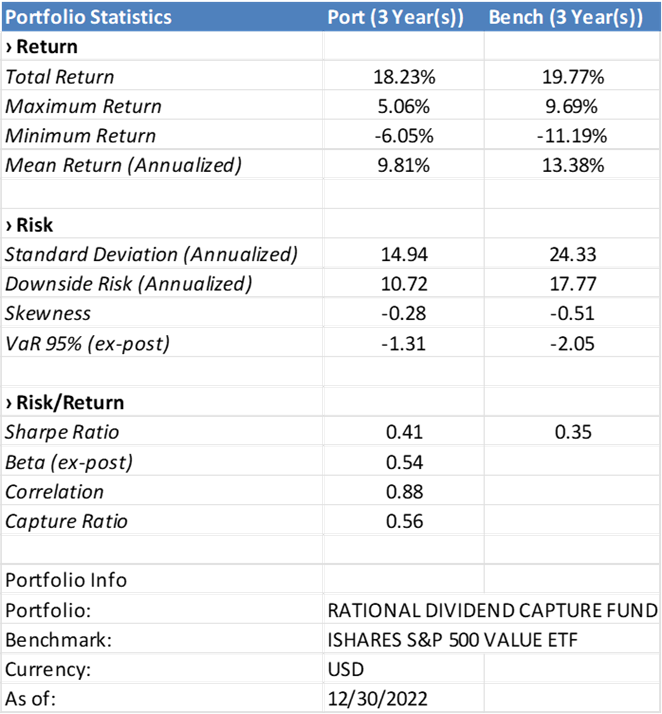

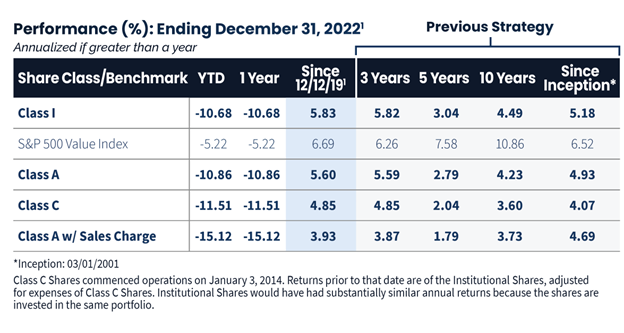

HDCTX Has Provided Better Risk Adjusted Returns Than Other Funds in its Morningstar Category (Three-Year Period Ending 12/31/22)

So far, we’ve demonstrated how HDCTX has previously effectively managed volatility while also being able to take part in market upswing. But how does it compare to other funds in its Large Cap Value Morningstar category? HDCTX has a higher Sharpe Ratio than the average fund in its category, according to the data below. The chart below demonstrates HDCTX’s history of providing better risk-adjusted returns than similarly rated funds.

Source: Equity Armor Investments and Morningstar

HDCTX also recently received a 4-star Morningstar ranking for the 3-year period ending 12/31/2022, out of 1,155 funds in the large cap value category, based on risk-adjusted returns. This 3-year timeframe covers the period of management of the fund by our Equity Armor team.

We believe that HDCTX, with its above average risk adjusted returns and experienced management team, offers an attractive opportunity for investors seeking true diversification outside of traditional asset classes.

About the Author

Joe Tigay is Managing Partner at Equity Armor Investments, sub-advisor to a volatility-hedged equity strategy at Rational Funds. Joe began his career in finance as an options market maker with Stutland Equities LLC. in 2005, working on the Chicago Board of Options Exchange and specializing in electronic market making. In 2008, Mr. Tigay became a member trader of the Chicago Board of Options Exchange (CBOE). As a member trader, Joe was a very active market maker in both SPX and VIX options from 2008 to 2012. Discussing options, volatility, and market insight, Joe has appeared on Bloomberg, BNN, and has a regular segment on CBOE.tv. Joe graduated from Michigan State University with a B.A. in Economics. He currently holds licenses for Series 3, 56, 65.

The maximum sales charge for Class “A” Shares is 4.75%. Class “C” Shares held for less than one year are subject to a 1% CDSC. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please call 800-253-0412 or visit www.RationalMF.com. Expense ratios are 1.17%, 1.42%, and 2.17%, respectively, for the Institutional, Class A, and Class C shares.

Important Risk Considerations:

Past performance is not a guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Rational Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (800) 253-0412 or at rationalmf.com. The prospectus should be read carefully before investing. The Rational Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Rational Advisors, Inc. is not affiliated with Northern Lights Distributors, LLC.

The S&P 500 Value Total Return Index is an unmanaged market-capitalization weighted index consisting of those stocks within the S&P 500 that exhibit strong value characteristics. It uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index.

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund’s portfolio. The performance of the Fund may be subject to substantial short-term changes. To the extent the Fund invests in the stocks of smaller-sized companies, the Fund may be subject to additional risks, including the risk that earnings and prospects of these companies are more volatile than larger companies. Smaller-sized companies may experience higher failure rates than larger companies and normally have lower trading volume than larger companies. These factors may affect the value of your investment. Investments in real estate investment trusts (REITS) involve special risks associated with an investment in real estate, such as limited liquidity and interest rate risks, and may be more volatile than other securities. There are no guarantees that dividend paying stocks will continue to pay dividends. In addition, dividend paying stocks may not experience the same capital appreciation potential as non-dividend. The performance of the Fund is based in part on the prices of one or more of the VIX Futures or other similar volatility-related products in which the Fund invests. Each of the equity securities held by the Fund and the VIX Futures or other similar volatility-related products are affected by a variety of factors and may change unpredictably, affecting the value of such equity securities and VIX Futures or other similar volatilityrelated products and, consequently, the value and the market price of the Fund’s shares.

Based on the risk-adjusted returns, HDCTX also rated 2-stars, 2-stars and 1-star by Morningstar for the period ending 12/31/2022, for the Overall, 5-year and 10-year periods, out of 1,155, 1,088 funds and 799 funds respectively, in the Large Value category. © 2022 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The Morningstar RatingTM for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life sub-accounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchangetraded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and ten-year (if applicable) Morningstar Rating metrics.

6029-NLD-01272023

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.