Has your fixed income outperformed its risk?

Ours has. The numbers prove it.

Ours has. The numbers prove it.

The Rational Special Situations Income Fund (RFXIX) has the potential to provide attractive risk-adjusted returns for your portfolio.

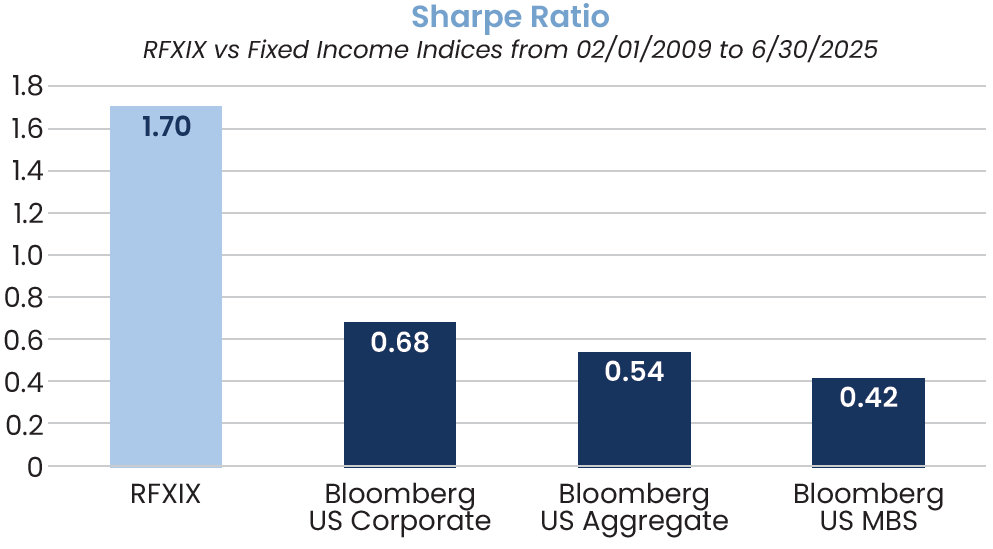

Sharpe Ratio

Sharpe Ratio measures an investment’s risk-adjusted return by comparing its excess returns (above a risk-free rate) to the level of risk, or volatility, it takes.

- Sharpe Ratio of 1

For every unit of risk an investment takes, it earns one unit of reward. In other words, the investment earns a return in line with its risk. - Sharpe Ratio greater than 1

Signals that the investment is delivering better-than-expected returns for its risk. - Sharpe Ratio less than 1

Signals the investment is not compensating investors enough for the level of risk they’re taking.

Through multiple rate environments, economic uncertainty, and rising fiscal deficits, the Rational Special Situations Income Fund (RFXIX) has managed to deliver strong risk-adjusted returns when compared to traditional fixed income benchmarks (shown in the chart below). RFXIX utilizes a strategy that, in recent years, has effectively managed the two main risks faced by fixed income investors, interest rate risk and credit risk, and combines that with an alpha generating special situations component.

Traditional fixed income may not be rewarding you for the risk you’re taking.

Source: Bloomberg LP and Rational Advisors, Inc. Past performance does not guarantee future results. The risk-free rate used for these calculations

is 0.5%. Please see important disclosures at the end of this presentation.

RFXIX primarily investments in non-agency residential mortgage-backed securities (RMBS) and a “special situations” component that seeks to exploit inefficiencies or flaws in certain debt issuances. The Fund also employs risk mitigation strategies that have reduced the impact of interest rate risk and credit risk and has led to strong risk-adjusted returns over the past five years.

RFXIX offers the potential to mitigate interest rate risk and credit risk.

Interest Rate Risk

- Aims to minimize interest rate sensitivity through a short duration portfolio (typically 1-1.5 years).

- Invests a portion of its assets in floating rate securities.

- As of 6/30/2025, RFXIX’s duration is 0.96 years.

Credit Risk

- Typically invests in RMBS that were issued before the Global Financial Crisis of 2008.

- Most bonds in these securities have a long history of repayment.

- We believe these “legacy” bonds have a lower potential to default.

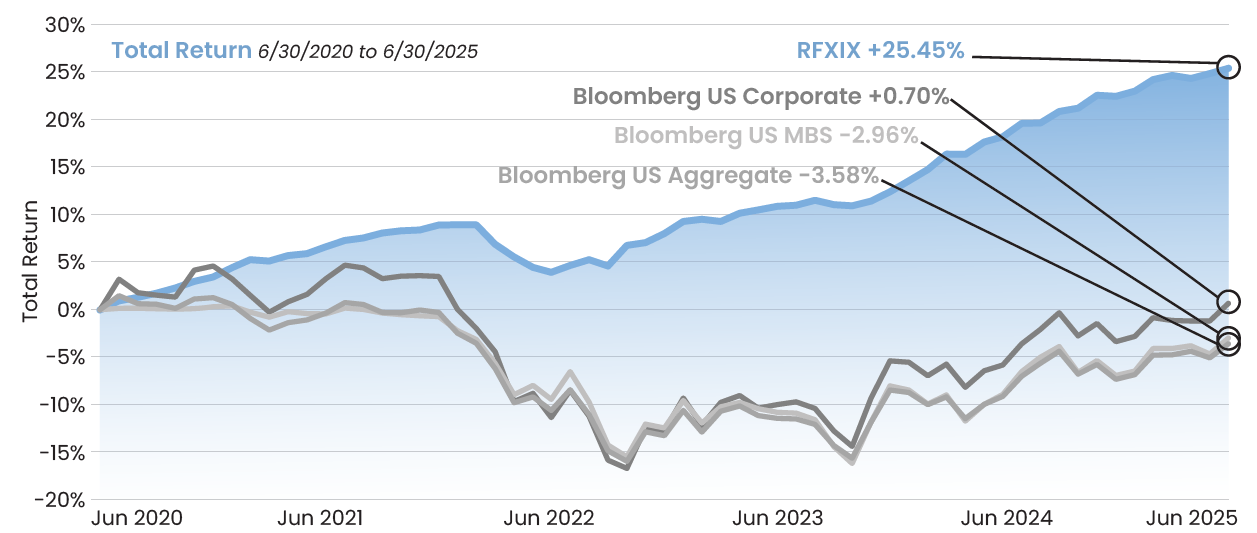

RFXIX has significantly outperformed over the past 5 years.

Source: Bloomberg LP and Rational Advisors, Inc. Past performance does not guarantee future results. Please see important disclosures at the end of this presentation.

Summary and Key Characteristics

- RFXIX combines investments in non-agency RMBS with a “special situations” component that seeks to provide asymmetric upside return potential.

- The Fund uses a variety of strategies in an effort to mitigate credit risk and interest rate risk.

- RFXIX’s focus on risk mitigation and alpha generation has resulted in attractive levels of risk-adjusted returns that we believe are sustainable in the future.

Data as of Quarter End: 2025-09-30T00:00:00

Annualized if greater than a year

| Share Class | 1 Month | 3 Months | 6 Months | YTD | 1 Year | 3 Years Annualized | 5 Years Annualized | 10 Years Annualized | Since Inception Annualized |

| Class A | 0.81% | 1.11% | 1.63% | 3.41% | 4.77% | 6.39% | 4.26% | 6.06% | 11.48% |

| Class C | 0.75% | 0.92% | 1.26% | 2.86% | 3.95% | 5.60% | 3.49% | 5.27% | 10.65% |

| Class I | 0.46% | 1.57% | 5.15% | 5.15% | 6.59% | 3.50% | 3.70% | 6.31% | 12.25% |

| Class A w/Sales Load | -3.97% | -3.71% | -3.17% | -1.50% | -0.19% | 4.67% | 3.25% | 5.54% | 11.15% |

Investments in mutual funds involve risks. Maximum sales charge for Class A is 4.75%. Maximum Deferred Sales Charge of 1.00% on Class C Shares applies to shares sold within 12 months of purchase. The Total Annual Fund Operating Expenses are 1.83%, 2.08%, and 2.77% for Class I, A, and C shares, respectively. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Results shown reflect the waiver, without which the results could have been lower. A fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. To obtain the most recent month end performance information or the Fund’s prospectus please call 800-253-0412 or visit www.rationalmf.com.

There is no assurance that the Fund will achieve its investment objective. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. The performance shown prior to July 17, 2019 is that of the Predecessor Fund, which reflects all of the Predecessor Fund’s actual fees and expenses adjusted to include any fees of each share class.

Glossary:

Alpha: A term used to describe an investment strategy’s ability to beat the market, or its “edge.”

Bloomberg US Aggregate Total Return Index: A market capitalization weighted index that is designed to measure the performance of the U.S. investment grade bond market with maturities of more than one year.

Bloomberg US Mortgage-Backed Securities (MBS) Total Return Index: Tracks agency mortgage pass-through securities.

Bloomberg US Corporate TR Index: Measures the U.S. investment grade, fixed-rate, taxable corporate bond market.

Duration: Measures approximately how much a bond’s price will change when interest rates move.

Floating Rate Securities: Bonds or loans that have an interest rate that periodically adjusts based on a predetermined benchmark.

Non-agency residential mortgage-backed securities (RMBS): Debt-based assets backed by the interest paid on residential loans. These assets are constructed by a nongovernment agency investment-banking firm.

Past performance is not a guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Rational Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (800) 253-0412 or at www.rationalmf.com. The prospectus should be read carefully before investing. The Rational Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Neither Rational Advisors, Inc. or ESM Management LLC is affiliated with Northern Lights Distributors, LLC.

Important Risk Considerations

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund’s portfolio. Investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategies. The Fund is non-diversified and may invest a greater percentage of its assets in a particular issue and may own fewer securities than other mutual funds. The Fund is subject to concentration risk. When the Fund invests in asset-backed securities and mortgage backed securities, the Fund is subject to the risk that, if the underlying borrowers fail to pay interest or repay principal, the assets backing these securities may not be sufficient to support payments on the securities. Interest rate risk is the risk that bond prices overall, including the prices of securities held by the Fund, will decline over short or even long periods of time due to rising interest rates. Bonds with longer maturities tend to be more sensitive to interest rates than bonds with shorter maturities. Lower-quality bonds, known as “high yield” or “junk” bonds, present greater risk than bonds of higher quality, including an increased risk of default. Credit risk is the risk that the issuer of a security will not be able to make principal and interest payments when due. These factors may affect the value of your investment.

The Fund commenced operations by acquiring all of the assets and liabilities of ESM Fund I, L.P. (the “Predecessor Fund”) in a tax free reorganization on July 17, 2019 (the “Reorganization”). In connection with the Reorganization, investors in the Predecessor Fund received Institutional Shares of the Fund. The Fund’s investment objectives, policies, guidelines, and restrictions are, in all material respects, equivalent to those of the Predecessor Fund. However, the Predecessor Fund was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and, therefore, was not subject to certain investment restrictions, limitations and diversification requirements that are imposed by the 1940 Act or Subchapter M of the Internal Revenue Code of 1986, as amended, which, if they had been applicable, might have adversely affected the Predecessor Fund’s performance. The Fund’s Sub-Advisor was the investment adviser to the Predecessor Fund. The Fund’s fees and expenses are expected to be higher than those of the Predecessor Fund, so if the Fund’s expenses were applied to the Predecessor Fund’s performance, the performance would have been lower.

The Fund commenced operations on July 17, 2019. The performance shown prior to July 17, 2019, is that of the Predecessor Fund, which reflects all of the Predecessor Fund’s actual fees and expenses (i.e., the Predecessor Fund’s annual management fees and operating expenses before any fee waivers and/or expense subsidies), as adjusted to include any applicable sales loads and distribution (12b-1) fees of each class of shares of the Fund. The performance of the Predecessor Fund has not been restated to include the other fees, estimated expenses and fee waivers and/or expense subsidies applicable to each class of shares of the Fund. The Fund’s fees and expenses are expected to be higher than those of the Predecessor Fund, so if the Fund’s expenses were applied to the Predecessor Fund’s performance, the performance would have been lower.

20250922-4831299