Rational/Pier 88 Convertible Securities Fund

Tickers: PBXAX | PBXCX | PBXIX

Fund Objective

The Fund’s objective is to seek total return consisting of capital appreciation and income.

Fund Highlights

-

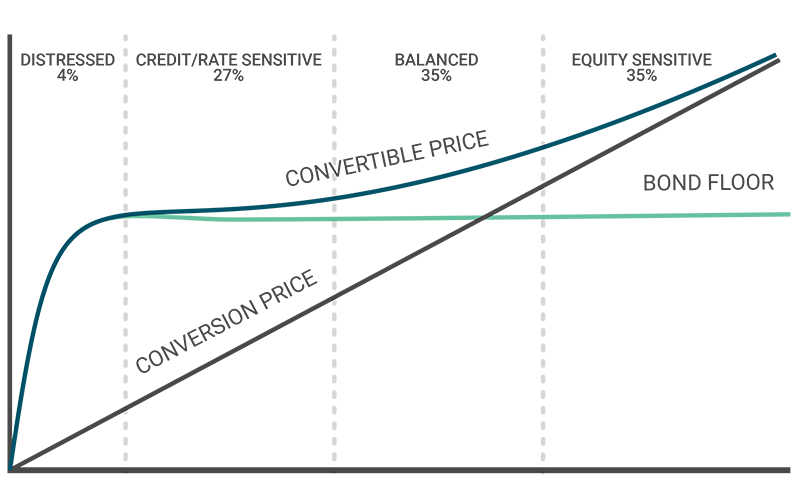

Convertible bonds participate in market upside, but offers equity participation with the benefit of a bond floor component.

-

The Fund will primarily focus on equity-sensitive, balanced and credit sections of the market

-

Convertibles have a lower historical default rate than high yield1

1Source: Barclays Research

Investment Strategy

Opportunity

The Fund invests primarily in convertible securities, which are “hybrid” securities that possess both fixed income and equity characteristics. A convertible security is a bond, preferred stock or another security that may be converted into a prescribed amount of common stock at a pre-stated price. The convertible securities asset class is often overlooked because of the unique profile and thus trades at a discount to its pari-passu fixed income counterparts.

Equity Sensitivity

Equity sensitivity has been the primary driver of returns of the asset class. The managers employ an equity analysis perspective for investment decisions.

Value

The investment team establishes a view on the intrinsic value of a business and then examines the overall capital structure of that asset to identify potential mispricing.

Portfolio Structure

The investment team establishes a view on the intrinsic value of a business and then examines the overall capital structure of that asset to identify potential mispricing.

Portfolio Manager Insights

Fund Management

Pier 88 Investment Partners, LLC is a San Francisco-based alternative asset management firm established in October 2013. We seek to provide investors with above-market returns through investments in public equities and convertible bonds. Our investment philosophy is rooted in a thorough understanding of the overall macro environment and deep fundamental research of our portfolio companies. We employ a disciplined approach to identify strategic companies where a patient investor can unlock value that is overlooked by those with shorter investment horizons. Pier 88 principals operate under the assumption that investing money for clients is a privilege —deserving of respect, dedication, and commitment to long-term partnership.

Francis T. Timons

- CEO and CIO of Pier 88

- Previously Portfolio Manager at Lord Abbett & Co. for the convertible, large cap core, and large cap value strategies

- Previously Research Analyst at Lord Abbett & Co and Robert W. Baird & Co.

- B.A. and J.D. from Notre Dame and MBA from University of Chicago

Sean J. Aurigemma

- Partner and CCO of Pier 88

- Previously Lead Portfolio Manager at Lord Abbett & Co. for the large cap value and value equity strategies

- Previously Managing Director and Lead Portfolio Manager at Morgan Stanley Investment Management

- B.A. with High Honors from Notre Dame

Fund Overview

Data as of: 2025-07-17T00:00:00

| Ticker | PBXAX | PBXCX | PBXIX | PBXAX |

| Share Class | Class A | Class C | Class I | Class A w/ Sales Load |

| CUSIP | 628255424 | 628255416 | 628255390 | 628255424 |

| Inception Date | 2017-03-01T00:00:00 | 2017-03-01T00:00:00 | 2017-03-01T00:00:00 | 2017-03-01T00:00:00 |

| As of Date | 2025-07-17T00:00:00 | 2025-07-17T00:00:00 | 2025-07-17T00:00:00 | 2025-07-17T00:00:00 |

| Daily NAV | 11.13 | 11.05 | 11.15 | 11.13 |

| NAV Change | 0.07 | 0.07 | 0.07 | 0.07 |

| % NAV Change | 0.63% | 0.64% | 0.63% | 0.63% |

Current Fund Performance

Data as of: 2025-07-17T00:00:00

| Share Class | 1 Month | 3 Months | 6 Months | YTD | 1 Year | 3 Years Annualized | 5 Years Annualized | 10 Years Annualized | Since Inception Annualized |

| Class A | 3.75% | 5.89% | 0.86% | 1.85% | 5.57% | 4.69% | 4.25% | N/A | 6.34% |

| Class C | 3.68% | 5.74% | 0.40% | 1.40% | 4.79% | 3.93% | 3.48% | N/A | 5.58% |

| Class I | 3.71% | 6.04% | 0.98% | 1.98% | 5.80% | 5.08% | 4.57% | N/A | 6.62% |

| Class A w/Sales Load | -1.15% | 0.88% | -3.93% | -3.03% | 0.56% | 3.01% | 3.25% | N/A | 5.73% |

Does not include pre-converted performance.

Quarterly Fund Performance

Data as of Quarter End: 2025-06-30T00:00:00

| Share Class | 1 Month | 3 Months | 6 Months | YTD | 1 Year | 3 Years Annualized | 5 Years Annualized | 10 Years Annualized | Since Inception* Annualized |

| Class A | 1.97% | 2.72% | 0.75% | 0.75% | 5.81% | 4.35% | 4.68% | N/A | 6.24% |

| Class C | 1.89% | 2.46% | 0.30% | 0.30% | 4.92% | 3.59% | 3.90% | N/A | 5.47% |

| Class I | 2.03% | 2.78% | 0.88% | 0.88% | 6.03% | 4.73% | 5.00% | N/A | 6.52% |

| Class A w/Sales Load | -2.90% | -2.13% | -4.07% | -4.07% | 0.80% | 2.67% | 3.66% | N/A | 5.62% |

*Inception: 03/01/2017 (I Share) & 12/6/2019 (A & C Shares). The performance shown for A & C shares prior to December 6, 2019 is that of the Predecessor Fund, which reflects all of the Predecessor Fund’s actual fees and expenses adjusted to include any fees of each share class.

Maximum sales charge for Class A is 4.75%. Maximum Deferred Sales Charge of 1.00% on Class C Shares applies to shares sold within 12 months of purchase. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Results shown reflect the waiver, without which the results could have been lower. A fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. To obtain the most recent month end performance information or the Fund’s prospectus please call 800-253-0412 or visit www.RationalMF.com.

Fund Expenses

Data as of: 2025-07-17T00:00:00

| Share Class | Class I | Class A | Class C | Class A w/ Sales Load |

| Prospectus Gross Expense Ratio (May 1, 2025) | 1.16% | 1.46% | 2.14% | 1.46% |

| Prospectus Net Expense Ratio* (May 1, 2025) | 0.99% | 1.24% | 1.99% | 1.24% |

* Rational Advisors, Inc. (the “Advisor”), has contractually agreed to waive all or a portion of its management fee and/or reimburse certain operating expenses of the Fund to the extent necessary in order to limit the Total Annual Fund Operating Expenses (excluding (i) acquired fund fees and expenses; (ii) brokerage commissions and trading costs; (iii) interest (including borrowing costs and overdraft charges), (iv) taxes, (v) short sale dividends and interest expenses, and (vi) non-routine or extraordinary expenses, such as regulatory inquiry and litigation expenses) to not more than 0.99%, 1.24% and 1.99% of the average daily net assets of the Fund’s Institutional, Class A, and Class C shares, respectively, through April 30, 2026.

Past performance is not a guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Rational Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (800) 253-0412 or at www.RationalMF.com. The prospectus should be read carefully before investing. The Rational Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Rational Advisors, Inc. is not affiliated with Northern Lights Distributors, LLC.

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund’s portfolio. The Fund is a new mutual fund and has a limited history of operations for investors to evaluate. Investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategies. The Fund is non-diversified and may invest a greater percentage of its assets in a particular issue and may own fewer securities than other mutual funds; the Fund is subject to concentration risk. Investments in convertible securities subject the Fund to the risks associated with both fixed-income securities, including credit risk and interest risk, and common stocks. A portion of the Fund’s convertible securities may be rated below investment grade. Exchangeable and synthetic convertible securities may be more volatile and less liquid than traditional convertible securities. In general, stock and other equity security values fluctuate, and sometimes widely fluctuate, in response to activities specific to the company as well as general market, economic and political conditions. Lower rated fixed-income securities are subject to greater risk of loss of income and principal than higher-rated securities. The prices of lower rated bonds are likely to be more sensitive to adverse economic changes or individual corporate developments. All fixed-income securities are subject to two types of risk: credit risk and interest rate risk. Interest rate risk is the risk that bond prices overall, including the prices of securities held by the Fund, will decline over short or even long periods of time due to rising interest rates. Bonds with longer maturities tend to be more sensitive to interest rates than bonds with shorter maturities. Lower-quality bonds, known as "high yield" or "junk" bonds, present greater risk than bonds of higher quality, including an increased risk of default. Credit risk is the risk that the issuer of a security will not be able to make principal and interest payments when due. These factors may affect the value of your investment.

The Fund commenced operations by acquiring all of the assets and liabilities of Lake Como Convertible Bond Fund, L.P. (the “Predecessor Fund”) in a tax-free reorganization on December 6, 2019 (the “Reorganization”). In connection with the Reorganization, investors in the Predecessor Fund received Institutional Shares of the Fund. The Fund’s investment objectives, policies, guidelines and restrictions are, in all material respects, equivalent to those of the Predecessor Fund. However, the Predecessor Fund was not registered under the 1940 Act and, therefore, was not subject to certain investment restrictions, limitations and diversification requirements that are imposed by the 1940 Act or Subchapter M of the Internal Revenue Code that, if they had been applicable, might have adversely affected the Predecessor Fund’s performance. The Fund’s Sub-Advisor was the investment adviser to the Predecessor Fund.