September 2025

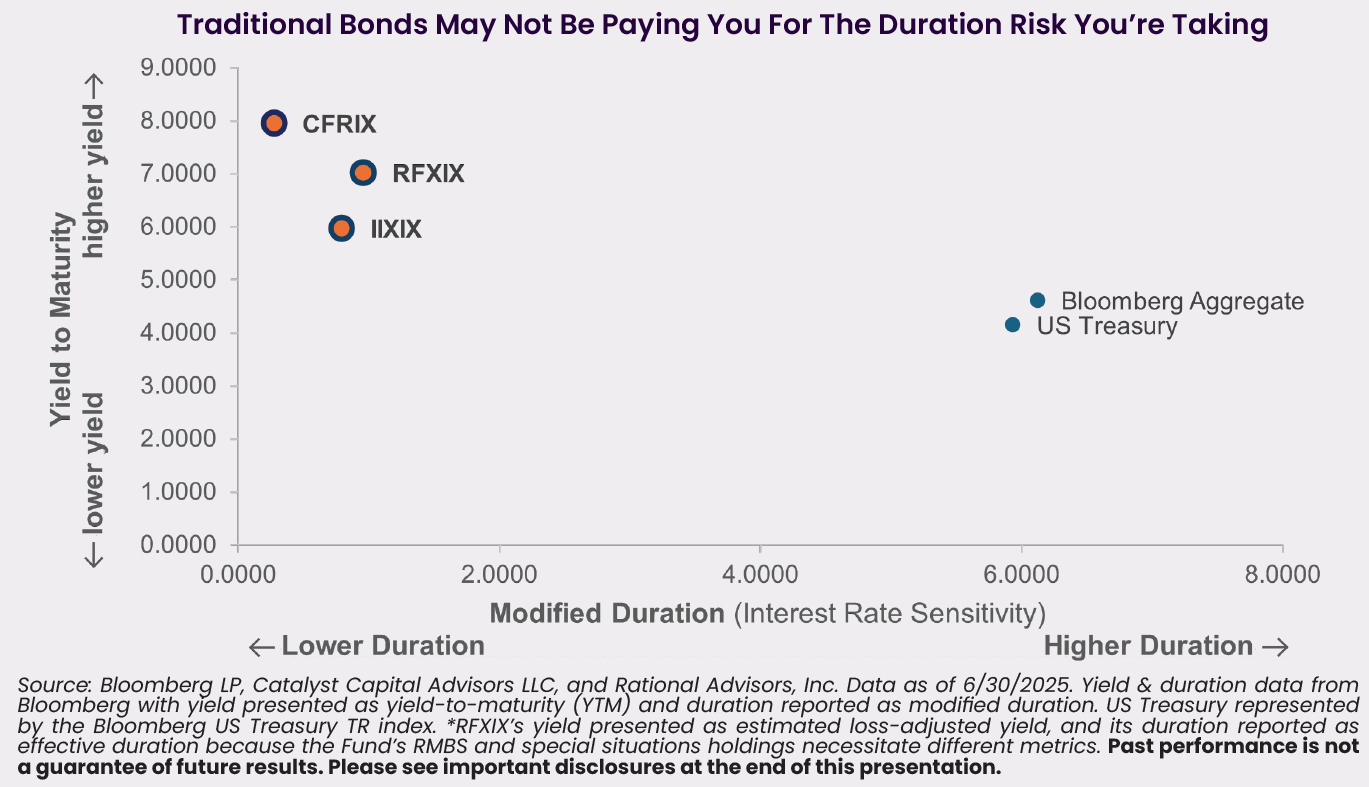

CFRIX, RFXIX, and IIXIX are low duration strategies for a volatile rate environment.

Duration measures approximately how much a bond’s price will change when interest rates move. A bond with a duration of 5 drops in price by 5% when rates rise 1% and rises in price by 5% when rates fall 1%. This inverse relationship can theoretically benefit long duration investors when rates decline. But while the Fed may soon cut rates, they may not go down in a way that investors would normally anticipate. Take for example what happened in September 2024, when a Fed rate cut failed to immediately push rates down across the board.

Trying to time the direction of interest rates has the potential to burn investors, so take a vacation from duration by considering our short duration fixed-income solutions.

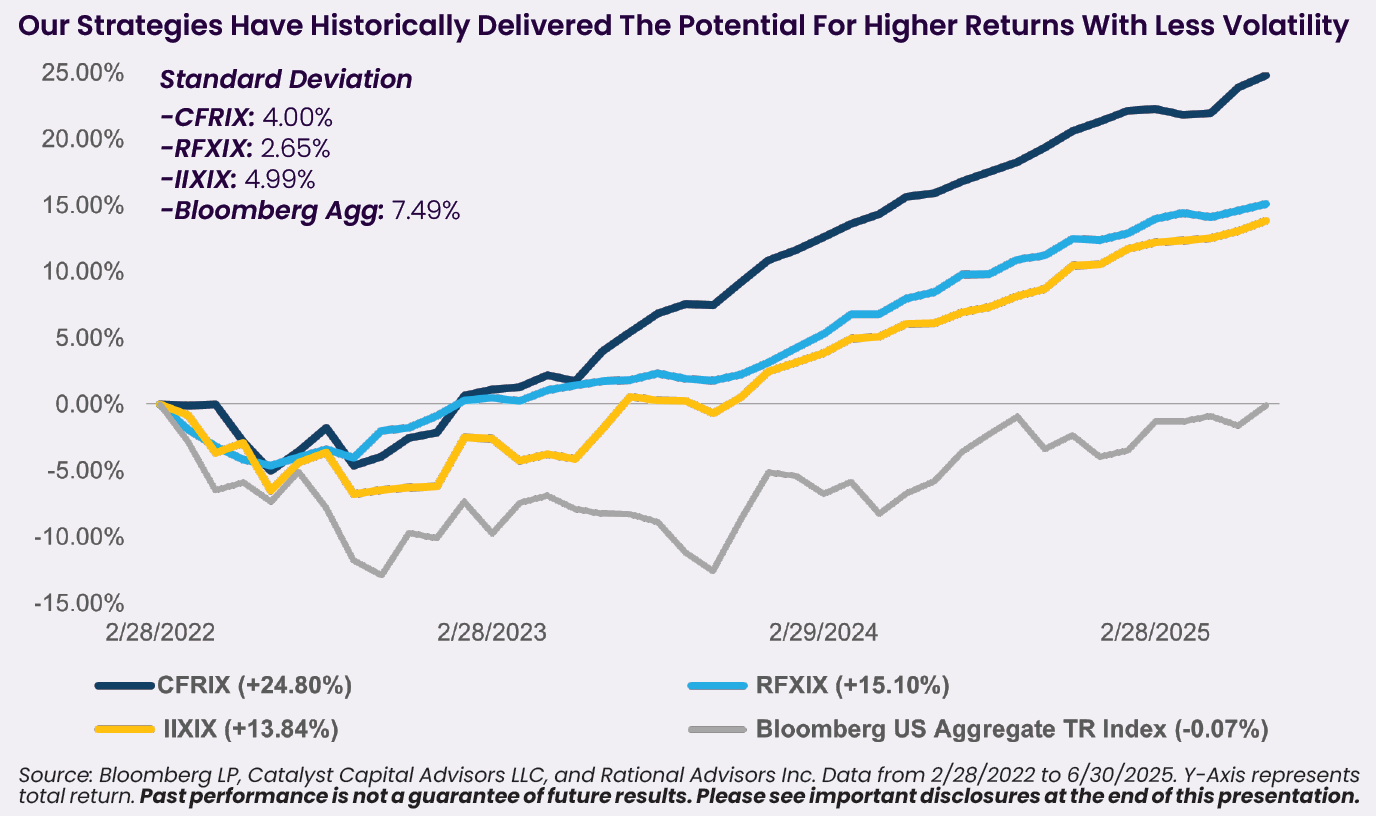

The Catalyst/CIFC Senior Secured Income Fund (CFRIX), Rational Special Situations Income Fund (RFXIX), and Catalyst Insider Income Fund (IIXIX) have all outperformed bonds, represented by the Bloomberg US Aggregate TR Index (“Agg”), since the Fed began raising rates in March 2022. Each Fund is generally short duration and offers the potential for higher yields when compared to the Agg, which has led to relatively strong total returns.

CFRIX, RFXIX, and IIXIX invest in senior secured loans, non-agency residential mortgage-backed securities, and short-term corporate bonds of companies experiencing insider buying, respectively. Each Fund has a distinct approach while seeking ways to mitigate interest rate (IR) risk.

- Differentiator: CFRIX uses a disciplined, research-intensive approach to company and security selection that has resulted in there being only one default in the portfolio since August 2018.

- Mitigates IR Risk: Senior secured corporate loans are typically adjustable, floating rate, or bank loans.

- Differentiator: RFXIX has a special situations component which may provide asymmetric upside return potential by identifying inefficiencies or flaws in the legal or technical structure of debt.

- Mitigates IR Risk: Invests a portion of its assets in floating rate securities.

- Differentiator: Insider buying has historically served as a positive signal for IIXIX because we believe insiders are unlikely to buy their own firm’s stock if they do not believe in the firm’s future prospects.

- Mitigates IR Risk: Portfolio of corporate bonds has an average modified duration of less than 3.5 years.

Performance (%) Ending June 30, 2025

| Fund | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception* |

| CFRIX | 7.64 | 9.52 | 6.68 | 4.87 | 4.91 |

| RFXIX | 6.10 | 6.46 | 4.64 | 6.27 | 11.86 |

| IIXIX | 7.27 | 6.77 | 3.82 | 3.12 | 2.66 |

*CFRIX Inception Date: 12/31/2012. RFXIX Inception Date: 02/01/2009. IIXIX Inception Date: 07/29/2014.

Past Performance is not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month –end, please call toll-free 866-447-4228.

| Fund | Net Expense* | Gross Expense |

| CFRIX | 0.92% | 1.25% |

| RFXIX | 1.77% | 1.83% |

| IIXIX | 0.75% | 1.14% |

*Net expense limitation agreements for CFRIX & IIXIX are contractually agreed upon until 10/31/2025. Net expense limitation agreement for RFXIX is contractually agreed upon until 04/30/2026. Absent these arrangements, each Fund’s performance above would have been lower.

INVESTORS SHOULD CAREFULLY CONSIDER THE INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES OF BOTH THE CATALYST FUNDS AND THE RATIONAL FUNDS. THIS AND OTHER IMPORTANT INFORMATION ABOUT EACH FUND IS CONTAINED IN THE APPLICABLE PROSPECTUS, WHICH CAN BE OBTAINED BY CALLNG 866-447-4228 OR AT EITHER WWW.CATALYSTMF.COM OR WWW.RATIONALMF.COM. THE APPLICABLE PROSPECTUS SHOULD BE READ CAREFULLY BEFORE INVESTING. THE CATALYST FUNDS AND THE RATIONAL FUNDS ARE DISTRIBUTED BY NORTHERN LIGHTS DISTRIBUTORS, LLC, MEMBER FINRA/SIPC. NEITHER CATALYST CAPITAL ADVISORS LLC NOR RATIONAL ADVISORS, INC. ARE AFFILIATED WITH NORTHERN LIGHTS DISTRIBUTORS, LLC.

Risk Considerations:

Investing in the Funds carries certain risks. The value of the Funds may decrease in response to the activities and financial prospects of an individual security or group of securities in the Funds’ portfolios. Investments in foreign securities could subject the Funds to greater risks, including, currency fluctuation, economic conditions, and different governmental and accounting standards. The Funds’ portfolios may be focused on a limited number of industries, asset classes, countries, or issuers. The Funds may invest in high yield or junk bonds which present a greater risk than bonds of higher quality. Other risks include credit risks and interest rate risk for floating rate loan funds. Changes in short-term market interest rates will directly affect the yield on the shares of a Fund whose investments are normally invested in floating rate debt. Floating rate loan funds tend to be illiquid, the Funds might be unable to sell the loan in a timely manner as the secondary market is private, unregulated inter-dealer or inter-bank re-sale market. Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income prices will fall. MBS and ABS may be more sensitive to changes in interest rates and may results in prepayments which can include the possibility that securities with stated interest rates may have the principal prepaid earlier than expected, which may occur when interest rates may have the principal prepaid earlier than expected, which may occur when interest rates decline. Rates of prepayment faster or slower than expected could reduce the Fund’s yield, increase the volatility of the Fund ad/or cause a decline in NAV. These factors may affect the value of your investment.

Prior to August 1, 2018, CFRIX was managed by a different sub-advisor with different investment strategies and policies. CFRIX’s past performance may have been different if it were managed by the current Sub-Advisor and consequently the performance record may be less pertinent for investors considering whether to purchase shares of CFRIX. CFRIX’s investment strategies changed on November 1, 2020 to permit CFRIX to use derivative instruments for hedging purposes.

RFXIX commenced operations by acquiring all of the assets and liabilities of ESM Fund I, L.P. (the “Predecessor Fund”) in a tax-free reorganization, which was consummated after the close of business on July 17, 2019 (the “Reorganization”). In connection with the Reorganization, investors in the Predecessor Fund received Institutional shares of RFXIX. RFXIX’s investment objectives, policies, guidelines and restrictions are, in all material respects, equivalent to those of the Predecessor Fund. However, the Predecessor Fund was not registered under the 1940 Act and, therefore, was not subject to certain investment restrictions, limitations and diversification requirements that are imposed by the 1940 Act or Subchapter M of the Internal Revenue Code of 1986, as amended, which, if they had been applicable, might have adversely affected the Predecessor Fund’s performance. RFXIX’s Sub-Advisor was the investment adviser to the Predecessor Fund. The performance shown prior to July 17, 2019, is that of the Predecessor Fund, which reflects all of the Predecessor Fund’s actual fees and expenses (i.e., the Predecessor Fund’s annual management fees and operating expenses before any fee waivers and/or expense subsidies), as adjusted to include any applicable sales loads and distribution (12b-1) fees of each class of shares of RFXIX. The performance of the Predecessor Fund has not been restated to include the other fees, estimated expenses and fee waivers and/or expense subsidies applicable to each class of shares of RFXIX. RFXIX’s fees and expenses are expected to be higher than those of the Predecessor Fund, so if RFXIX’s expenses were applied to the Predecessor Fund’s performance, the performance would have been lower.

Glossary:

Bloomberg US Aggregate TR Index: A market capitalization weighted index that is designed to measure the performance of the U.S. investment grade bond market with maturities of more than one year. Bloomberg US Treasury TR index: Measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury. Yield-to-Maturity (YTM): The internal rate of return that equates all future cash flows of a bond to its current price. Standard Deviation: A statistical measurement that looks at how far discrete points in a dataset are dispersed from the mean of that set. Asymmetric Upside: Describes a situation where the potential for profit is significantly greater than the potential for loss or risk taken. Floating Rate Securities: Bonds or loans that have an interest rate that periodically adjusts based on a predetermined benchmark.

Important Risk Considerations

Investing in the Fund carries certain risks. The Fund will invest a percentage of its assets in derivatives, such as futures, forwards and options contracts. The use of such derivatives and the resulting high portfolio turn-over may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities and commodities underlying those derivatives. The Fund may experience losses that exceed those experienced by funds that do not use futures, forwards, options and hedging strategies. Investing in commodities markets may subject the Fund to greater volatility than investments in traditional securities. Currency trading risks include market risk, credit risk and country risk. Foreign investing involves risks not typically associated with U.S. investments. Changes in interest rates and the liquidity of certain investments could affect the Fund’s overall performance. The Fund is non-diversified and, as a result, changes in the value of a single security or group of securities may have significant effect on the Fund’s value. Other risks include U.S. Government securities risks and investments in fixed income securities. Typically, a rise in interest rates causes a decline in the value of fixed income securities or derivatives owned by the Fund. Furthermore, the use of leveraging can magnify the potential for gain or loss and amplify the effects of market volatility on the Fund’s share price. The Fund is subject to regulatory change and tax risks; changes to current rules could increase costs associated with an investment in the

Fund. These factors may affect the value of your investment.

The Fund acquired all of the assets and liabilities of Millburn Hedge Fund, L.P. (the “Predecessor Fund”) in a tax free reorganization on December 28, 2015 (the “Reorganization”). In connection with the Reorganization, shares of the Predecessor Fund were exchanged for Class I shares of the Fund. Performance shown before December 28, 2015 is for the Predecessor Fund. The prior performance is net of management fees and other expenses, including the effect of the performance fee. The Predecessor Fund had an investment objective and strategies that were, in all material respects, the same as those of the Fund, and was managed in a manner that, in all material respects, complied with the investment guidelines and restrictions of the Fund. The Fund’s Sub-Adviser was the investment manager of the Predecessor Fund. From its inception through December 28, 2015, the Predecessor Fund was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended, or the Internal Revenue Code of 1986, as amended, which if they had been applicable, might have adversely affected its performance. In addition, the Predecessor Fund was not subject to sales loads that would have adversely affected performance. The Fund’s fees and expenses are expected to be higher than those of the Predecessor Fund; therefore, if the Fund’s expenses were applied to the Predecessor Fund’s performance, the performance would have been lower. Performance of the Predecessor Fund is not an indicator of future results.

20250916-4821405