Stability in Chaos: The Market Moves Forward Despite Global Tensions

Q3 2025 Market Outlook

Commentary as of June 30, 2025

The Macro View: Volatility, Tariffs, and Fed Jitters

By David Miller, Co-Founder and Chief Investment Officer, Catalyst Capital Advisors LLC and Rational Advisors, Inc.

As we begin Q3 2025, the investing landscape continues to be shaped by three dominant macro forces: persistent trade tensions, evolving interest rate policy, and slowing global growth expectations.

Markets entered July still recovering from the tariff-driven dislocation that rattled Q2. While the worst fears of an all-out global trade war have not materialized, tariff escalation with China, Canada, and Mexico remains a live risk. Investors are weighing the paradoxical potential for a “tariff recession” to catalyze Fed rate cuts—an echo of what we saw in 2020. In fact, markets now price in two 25 bps cuts by year-end, even as inflationary impulses remain stickier than expected due to supply chain shocks and deficit spending.

Key Signals to Watch in Q3:

- Federal Reserve Policy: After holding steady in Q2, markets expect clearer dovish signaling at the upcoming August Jackson Hole symposium and the September FOMC meeting.

- GDP Trajectory: Q1 GDP showed a deceleration. It is an open-ended question as to the direction of the trajectory going forward, but the new bill will likely be a stimulus.

- Consumer Confidence: Still fragile after a sharp Q2 drop, this remains a key sentiment barometer.

- Yield Curve Dynamics: The 2s/10s curve remains relatively flat in slope.

Mr. Miller is a portfolio manager for the Catalyst Systematic Alpha Fund (ATRFX), Catalyst Insider Buying Fund (INSIX), Catalyst Insider Income Fund (IIXIX), Rational Strategic Allocation Fund (RHSIX) and the Strategy Shares Gold Enhanced Yield ETF (GOLY).

Equity Markets: A Q2 Comeback, but Volatility Remains the Name of the Game

By Michael Dzialo, Karen Culver, Peter Swan, Zachary Fellows, John Dalton, and Nicolas Vilotti of the Managed Asset Portfolios Investment Team.

Investors would not know it from the slight gains in the broader market so far this year, but volatility has been the defining term for the first half of 2025. In fact, a recent Barron’s article mentioned that, on a risk-adjusted basis, returns for the S&P 500 this year have been in the 24th percentile since 1990, while volatility has been in the 89th percentile. Now, more so than ever, the broader markets react to headlines and tweets rather than facts and figures.

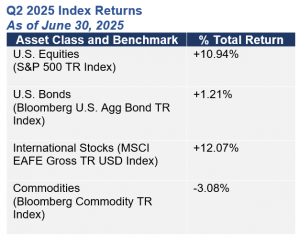

U.S. stocks fell in the first quarter after two consecutive years of gains amid rising policy uncertainty in Washington, marking the worst relative performance for U.S. stocks versus global markets in 23 years. Fast forward to the second quarter, and U.S. stocks rebounded following Liberation Day lows as global stocks treaded water. As we move into the third quarter, the same uncertainties that plagued the U.S. market in the first half of the year remain, including valuations, global macroeconomic activity, interest rates, and tariffs.

Despite the volatility this year, the S&P 500 is trading at 25.8 times trailing earnings, above the 5 and 10-year averages of 23.87 and 21.68, respectively. This compares to the MSCI ACWI ex-USA, trading at 15.92 times trailing earnings, slightly below the 5 and 10-year averages of 16.42 and 16.26, respectively. U.S. stocks have historically commanded premium valuations over most other countries for several reasons; however, we believe the delta between the two is too wide. Elevated valuations need the support of continued earnings growth. Companies reported decent earnings growth in the first quarter, yet many either pulled guidance for the rest of the year or issued softened guidance in the face of economic uncertainty.

Assessing the Health of the U.S. Economy

The U.S. economy has demonstrated remarkable resilience in 2025, but cracks are beginning to form. Our investment team is closely watching the labor market as layoffs rise, and recent college graduates are having difficulty finding a job. As such, we have a cautious view on the U.S. economy. At its most recent meeting, the Federal Reserve (the “Fed”) lowered its 2025 GDP forecast to 1.4% from 1.7% while raising its forecast for core inflation to 3.1% from 2.8% in anticipation of a tick up in inflation in the coming months stemming from tariffs. Eventually, we believe the Fed will succumb to political pressure and, as the economy slows, lower interest rates, further steepening the yield curve. Either way, Fed Chair Jerome Powell’s term ends in May 2026, and whoever President Trump selects to succeed him will likely share his views that the Fed needs to lower rates.

While U.S. investors grapple with uncertainty, markets outside the U.S. appear well-positioned over the long-term. We believe that U.S. trade policies should become catalysts to push foreign nations to spend more on infrastructure and defense. As we have witnessed in the U.S. over the past several decades, spending money is stimulative to the economy. We believe Europe may be in the preliminary stages of a substantial economic rebound as spending increases.

Why Investors Should Consider a Global, Active Approach

Overall, we believe an environment of heightened geopolitical and economic uncertainty strengthens the case for active management. While we monitor, we do not act on the seemingly daily barrage of tweets and headlines coming out of Washington. Rather, we look at the bigger picture. The investment team believes the U.S. dollar will trend lower over the next few years, not necessarily in a straight line, benefiting global equities as well as select commodities. We are also overweight those sectors that historically do not rely on strong economic growth, including the Consumer Staples, Health Care, and Utilities sectors.

Managed Asset Portfolios sub-advises the Catalyst/MAP Global Equity Fund (CAXIX) and the Catalyst/MAP Global Balanced Fund (TRXIX).

Fixed Income Outlook: Bond Markets & Murphy’s Law

By Michael Perini, Perini Capital LLC.

Murphy’s Law stating “what can go wrong will go wrong” seems like an apt description of life for fixed income investors since the beginning of 2022. Since then, investors in the asset class have had to grapple with the following:

- Multi trillion dollar increases in the Federal Reserve’s balance sheet.

- Fiscal stimulus and budget deficits that are more in line with wartime or deep recessions.

- Inflation that has not been seen since the 1970’s.

- An increase in the Federal Funds rate from 0.25% to 5.50%.

- Tariffs and the uncertainty associated with them.

- Decreased demand for U.S. Treasuries.

- Renewed conflict in the Middle East.

- The “Big Beautiful Bill”

However, perhaps the problems are not what they seem when viewed through a different lens. Maybe what fixed income investors need is a paradigm shift. While all the above-mentioned headwinds make it seem like it may be time to reduce exposure to fixed income, we disagree because of our non-traditional way of viewing the risks associated with fixed income.

In our view, there are three distinct risks to fixed income investors:

- Interest Rate Risk: The risk that interest rates rise.

- Reinvestment Risk: The risk that interest rates fall.

- Credit Risk: The risk of permanent impairment of capital due to defaults.

The events beginning in 2022 and continuing through today have been extremely painful from the standpoint of investors with significant interest rate risk. Interest rates have gone up (a lot!) and prices have gone down. From the standpoint of reinvestment risk, the interest rate environment since 2022 has been a big positive, as the reinvestment rate of incoming cash flows is much higher than it was prior to 2022. The reinvestment component of total return is often underappreciated, both as a counterweight to interest rate risk and as a key in creating return stability to a variety of forward interest rate scenarios. However, achieving this balance is not easy, nor is it often accessible via traditional fixed income solutions.

Traditional fixed income solutions, such as U.S. Treasuries, corporate bonds and municipal bonds, pay interest every six months and principal as a final payment at maturity; therefore, due to the lack of cash flow between issuance and maturity, the reinvestment rate of incoming cash flows is typically not a meaningful component of total return. In contrast, structured credit sectors, such as mortgage-backed-securities, often pay interest and principal every month, and because of this feature the reinvestment of incoming cash flows is generally a meaningful component of total return. Additionally, the higher the cash flow of a portfolio the lower price changes (because of changing rates) matter as a percentage of total return.

Given the uncertainty in today’s macro environment where interest rate volatility and direction will likely remain high and difficult to forecast, we believe investors should look to alternative fixed income solutions that can provide non-correlated returns, diversification and balance interest rate risk versus reinvestment risk. The paradigm shift mentioned herein has the potential to benefit investors when navigating the fixed income markets through the rest of 2025 and beyond.

Perini Capital LLC is the sub-advisor to the Catalyst/Perini Strategic Income Fund (CSIOX)

Spotlight: Why Gold Continues to Shine

By David Miller, Co-Founder and Chief Investment Officer, Catalyst Capital Advisors LLC and Rational Advisors, Inc.

Gold remains a standout asset class as we enter Q3—offering both a potential hedge against geopolitical chaos and an escape from fiat currency erosion. A few key reasons:

- Central Bank Demand Surging: BRICS nations—particularly China and India—are accelerating gold reserves accumulation as part of broader de-dollarization strategies.

- Deficits + Tariffs = Inflation Risk: Persistent U.S. fiscal deficits, now exacerbated by tariff-induced price pressures, add to the long-term inflation argument—which is generally supportive of gold prices.

- Yield Convergence: With bond yields declining and real rates pressured by inflation, the opportunity cost of holding gold is falling—reviving investor interest in gold ETFs and alternatives.

- Technical Breakout: Gold has held above $3,250/oz for much of June and shows signs of an upward breakout as volatility returns to equity markets.

Positioning Implications:

We believe that the current macro environment justifies a meaningful allocation to gold and gold-related strategies.

Looking ahead, the combination of fragile equity sentiment, uncertain policy direction, and structural macro headwinds reinforces our view: gold isn’t just a crisis hedge—it’s becoming a core asset class in the modern portfolio playbook.

IMPORTANT DISCLOSURES

Past performance is not a guarantee of future results.

INVESTORS SHOULD CAREFULLY CONSIDER THE INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES OF LIQUID ALTERNATIVE FUNDS, INCLUDING THE CATALYST FUNDS AND THE RATIONAL FUNDS. THIS AND OTHER IMPORTANT INFORMATION ABOUT A FUND IS CONTAINED IN THE PROSPECTUS, WHICH CAN BE OBTAINED BY CALLING 866-447-4228 OR AT WWW.CATALYSTMF.COM OR WWW.RATIONALMF.COM, AS APPLICABLE. THE RELEVANT PROSPECTUS SHOULD BE READ CAREFULLY BEFORE INVESTING. BOTH THE CATALYST FUNDS AND THE RATIONAL FUNDS ARE DISTRIBUTED BY NORTHERN LIGHTS DISTRIBUTORS, LLC (“NLD”). NLD HAS HAD NO ROLE IN THE STRUCTURING OR DISTRIBUTION OF ANY OTHER INVESTMENT PRODUCTS REFERENCED HEREIN, AND IS NOT RESPONSIBLE FOR THE MARKETING OR PROMOTIONAL MATERIAL RELATED TO THE OTHER INVESTMENT PRODUCTS PRODUCED OR SPONSORED BY ANY OTHER FIRM. DAVID MILLER, STRATEGY SHARES, MICHAEL DZIALO, KAREN CULVER, PETER SWAN, ZACHARY FELLOWS, JOHN DALTON, NICOLAS VILOTTI, MANAGED ASSET PORTFOLIOS, MICHAEL PERINI, AND PERINI CAPITAL LLC ARE NOT AFFILIATED WITH NLD.

Risk Considerations

Though the objectives, strategies and assets traded may differ significantly across liquid alternative approaches, investing in liquid alternatives generally carries certain risks. These risks may include, but are not necessarily limited to, the following: Certain funds may invest a percentage of their assets in derivatives, such as futures and options contracts. The use of such derivatives and the resulting high portfolio turn-over may expose such funds to additional risks that they would not be subject to if they invested directly in the securities and commodities underlying those derivatives. These funds may experience losses that exceed those experienced by funds that do not use futures contracts, options and hedging strategies. Investing in commodities markets may subject a fund to greater volatility than investments in traditional securities. Currency trading risks include market risk, credit risk and country risk. Foreign investing involves risks not typically associated with U.S. investments. Changes in interest rates and the liquidity of certain investments could affect a fund’s overall performance. Other risks include U.S. Government securities risks and investments in fixed income securities. Typically, a rise in interest rates causes a decline in the value of fixed income securities or derivatives owned by a fund. Furthermore, the use of leverage can magnify the potential for gain or loss and amplify the effects of market volatility on a fund’s share price. All funds are subject to regulatory change and tax risks; changes to current rules could increase costs associated with an investment in a fund.

The value of a fund may decrease in response to the activities and financial prospects of an individual security or group of securities held in a fund’s portfolio. Investments in foreign securities could subject a Fund to greater risks, including currency fluctuation, economic conditions, and different governmental and accounting standards. A fund’s portfolio may be focused on a limited number of industries, asset classes, countries or issuers. Certain funds may invest in high yield or junk bonds, which present a greater risk than bonds of higher quality. Other risks may include credit risks and interest rate risk, particularly with respect to floating rate loan funds. Changes in short-term market interest rates will directly affect the yield on the shares of a fund whose investments are normally invested in floating rate debt. Floating rate loan funds tend to be illiquid, and a fund might be unable to sell the loan in a timely manner as the secondary market is generally a private, unregulated inter-dealer or inter-bank re-sale market.

Any or all of the foregoing risk factors may affect the value of your investment.

The views expressed herein are as of June 30, 2025, and represent a general guide to the perspectives of the authors. The information and opinions contained in this document have been compiled or arrived at based on sources believed to be reliable and in good faith; however, no representations or warranties of any kind are intended or should be inferred with respect to the accuracy of the information contained herein or the economic return of an investment in a fund, and no assurance can be given that existing laws will not be changed or interpreted adversely. All such information and opinions are subject to change without notice.

Some of the statements in this presentation may contain or be based on forward looking statements, estimates, targets or prognoses (collectively, “forward looking statements”), which reflect the advisor’s current view of future events, economic developments and financial performance. Such forward looking statements are typically indicated by the use of words which express an estimate, expectation, belief, target or forecast. Such forward looking statements are based on an assessment of historical economic data, on the experience and current plans of the advisor and/or certain of its advisors, and on the indicated sources. These forward looking statements contain no representation or warranty of whatever kind that such future events will occur or that they will occur as described herein, or that such results will be achieved by any fund or the investments of any fund, as the occurrence of these events and the results of a fund are subject to various risks and uncertainties. The actual portfolio, and thus results, of a fund may differ substantially from those assumed in the forward looking statements. The opinions expressed reflect the advisor’s best judgment at the time this presentation was issued, and the advisorr and its affiliates will not undertake to update or review the forward looking statements contained in this presentation, whether as a result of new information or any future event or otherwise.

The advisor’s judgments about the growth, value or potential appreciation of an investment may prove to be incorrect or fail to have the intended results, which could adversely impact a Fund’s performance and cause it to underperform relative to other funds with similar investment goals or relative to its benchmark, or not to achieve its investment goal.

There is no assurance that these opinions or forecasts will come to pass, and past performance is no assurance of future results.

There is a risk that issuers and counterparties will not make payments on securities and other investments.

Glossary:

Bloomberg Commodity TR Index – designed to be a highly liquid and diversified benchmark for commodity investments.

Bloomberg US Aggregate Bond TR Index – A market capitalization-weighted index that is designed to measure the performance of the U.S. investment grade bond market with maturities of more than one year.

BRICS – an intergovernmental organization comprised of ten countries: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates.

Commodities – a basic good used in commerce that is interchangeable with other commodities of the same type. Investors and traders can buy and sell commodities directly in the spot (cash) market or via derivatives such as futures and options.

Credit Spreads – The difference in yield (return) between two debt instruments of the same maturity but with different credit ratings, reflecting the additional risk investors take on when lending to a borrower with a lower credit rating.

Currencies – money in the form of paper and coins that’s used as a medium of exchange. Currencies are created and distributed by individual countries around the world.

MSCI EAFE Gross TR USD Index – a broad market equity index that tracks the performance of large and mid-cap companies in 21 developed markets around the world, excluding the US and Canada.

S&P 500 TR Index – A market capitalization-weighted index that is used to represent the U.S. large-cap stock market.

20250702-4633644