Rational Strategic Allocation Fund

Tickers: RHSAX | RHSCX | RHSIX

Fund Objective

The Strategic Allocation Fund seeks current income and moderate appreciation of capital.

Fund Highlights

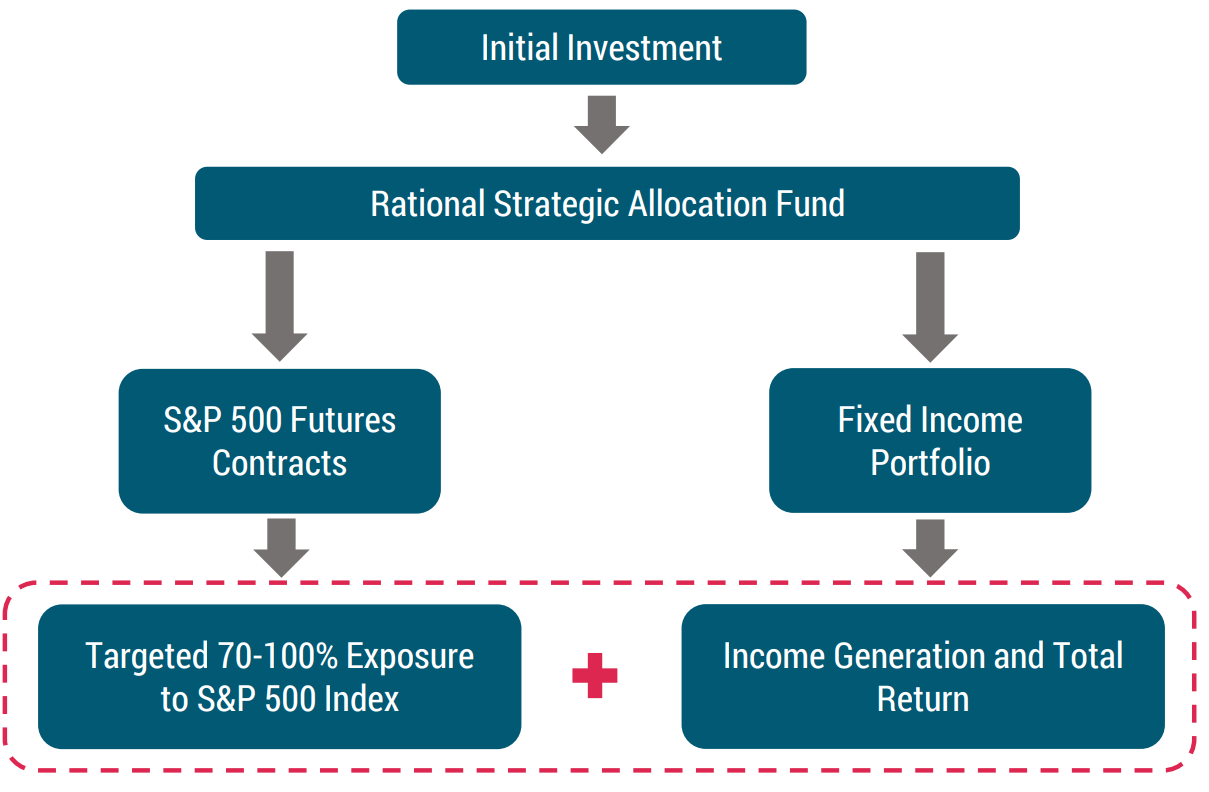

The Fund implements a distinct “index plus” strategy that provides investors exposure to a non-traditional fixed income portfolio with an S&P 500 Index equity overlay.

Investment Strategy

Portfolio Structure

The Fund invests in a portfolio of futures contracts on the S&P 500 Index and income-oriented mutual funds typically representing non-traditional fixed income asset classes with the objective to 1) provide current income, 2) provide additional return over the long term, and 3) support the goal of moderate capital appreciation by buffering the impact of downside equity market volatility.

Exposure

The Fund will typically maintain 70% to 100% notional exposure to the S&P 500 Index and 70% to 100% notional exposure to the fixed income portfolio.

Fixed Income

The fixed income portfolio consists of underlying funds focused on non-traditional fixed income asset classes such as non-agency residential and commercial mortgage backed securities, asset-backed securities, collateralized loan obligations, floating rate loans, and other floating rate investments. The fixed income portfolio may also include exposure to corporate debt and convertible securities.

Research

Fixed income funds are selected for investment based on a fundamental research process, including a top-down analysis of market conditions and investment category historical performance during various market conditions, and a bottom-up analysis, such as the fund’s investment allocations, valuations and characteristics.

Portfolio Manager Insights

Fund Management

Rational Funds lineup of innovative strategies are designed to support financial advisors and their clients in meeting the challenges of an ever-changing global financial market. We see the benefits of the Rational Funds being their ability to fit into various investment portfolios and enhance risk-adjusted performance through low correlation and non-traditional viewpoints.

The Rational Funds intent is to provide investors with non-traditional products that take advantage of boutique managers’ experience and expertise. Our Funds are managed by sub-advisors who focus on high alpha, low beta, with a strong long-term track record over multiple market cycles. Rational Funds’ seasoned investment managers combine innovative modern thinking with advanced technology to strive to be ahead of the curve in exploiting emerging areas of opportunity to help our clients achieve their long-term investment goals.

David Miller

- Co-Founder, Catalyst Capital Advisors

- Portfolio Manager of Fund since 2016

- B.S. in Economics, University of Pennsylvania Wharton School; MBA in Finance, University of Michigan Ross School of Business

Fund Overview

Data as of: 2024-05-07T00:00:00

| Ticker | RHSAX | RHSCX | RHSIX | RHSAX |

| Share Class | Class A | Class C | Class I | Class A w/ Sales Load |

| CUSIP | 628255846 | 628255762 | 628255754 | 628255846 |

| Inception Date | 2009-07-30T00:00:00 | 2016-05-31T00:00:00 | 2016-05-31T00:00:00 | 2009-07-30T00:00:00 |

| As of Date | 2024-05-07T00:00:00 | 2024-05-07T00:00:00 | 2024-05-07T00:00:00 | 2024-05-07T00:00:00 |

| Daily NAV | 9.17 | 9.09 | 9.12 | 9.17 |

| NAV Change | 0.07 | 0.06 | 0.07 | 0.07 |

| % NAV Change | 0.77% | 0.66% | 0.77% | 0.77% |

Current Fund Performance

Data as of: 2024-05-07T00:00:00

| Share Class | 1 Month | 3 Months | 6 Months | YTD | 1 Year | 3 Years Annualized | 5 Years Annualized | 10 Years Annualized | Since Inception Annualized |

| Class A | -1.61% | 7.53% | 25.13% | 14.07% | 32.13% | 5.68% | 6.66% | 5.60% | 6.34% |

| Class C | -1.84% | 7.26% | 24.56% | 13.70% | 31.20% | 4.92% | 5.88% | N/A | 5.93% |

| Class I | -1.62% | 7.51% | 25.27% | 14.22% | 32.48% | 5.95% | 6.93% | N/A | 6.97% |

| Class A w/Sales Load | -6.24% | 2.38% | 19.18% | 8.68% | 25.81% | 3.99% | 5.62% | 5.08% | 5.99% |

Quarterly Fund Performance

Data as of Quarter End: 2024-03-31T00:00:00

| Share Class | 1 Month | 3 Months | 6 Months | YTD | 1 Year | 3 Years Annualized | 5 Years Annualized | 10 Years Annualized | Since Inception Annualized |

| Class A | 7.99% | 18.17% | 31.76% | 18.17% | 37.46% | 9.40% | 7.51% | 5.90% | 6.64% |

| Class C | 7.96% | 18.08% | 31.50% | 18.08% | 36.63% | 8.67% | 6.75% | N/A | 6.52% |

| Class I | 7.97% | 18.35% | 31.95% | 18.35% | 37.66% | 9.66% | 7.79% | N/A | 7.55% |

| Class A w/Sales Load | 2.86% | 12.59% | 25.57% | 12.59% | 30.86% | 7.64% | 6.47% | 5.39% | 6.29% |

The maximum sales charge for Class “A” Shares is 4.75%. Class “C” Shares held for less than one year are subject to a 1% CDSC. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month end performance information or the Fund’s prospectus please call 800-253-0412 or visit www.RationalMF.com.

Fund Expenses

Data as of: 2024-05-07T00:00:00

| Share Class | Class I | Class A | Class C | Class A w/ Sales Load |

| Prospectus Gross Expense Ratio (May 1, 2024) | 2.51% | 2.88% | 3.22% | 2.88% |

| Prospectus Net Expense Ratio* (May 1, 2024) | 1.42% | 1.67% | 2.42% | 1.67% |

* Rational Advisors, Inc. has contractually agreed to waive all or a portion of its investment advisory fee and/or reimburse certain operating expenses of the Fund to the extent necessary in order to limit the Fund’s total annual fund operating expenses (excluding (i) acquired fund fees and expenses; (ii) brokerage commissions and trading costs; (iii) interest (including borrowing costs and overdraft charges), (iv) taxes, (v) short sale dividends and interest expenses, and (vi) non-routine or extraordinary expenses, such as regulatory inquiry and litigation expenses) to not more than 0.45%, 0.70% and 1.45% of the average daily net assets of the Fund’s Institutional, Class A, and Class C shares, respectively, through April 30, 2025.

Prior to December 6, 2019, the Fund implemented a different investment strategy.

Past performance is not a guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Rational Funds. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (800) 253-0412 or at www.RationalMF.com. The prospectus should be read carefully before investing. The Rational Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Rational Advisors, Inc. is not affiliated with Northern Lights Distributors, LLC.

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security in the Fund's portfolio. Because the Advisor is primarily responsible for managing both the Fund and certain Underlying Funds, the Advisor is subject to conflict of interest with respect to how it allocates the Fund's assets among the Underlying Funds. Derivatives are investments in which the value is "derived" from the value of an underlying asset, reference rate, or index. The value of derivatives may rise or fall more rapidly than other investments. For some derivatives, it is possible to lose more than the amount invested in the derivative. If the Fund uses derivatives to "hedge" the overall risk of its portfolio, it is possible that the hedge may not succeed. Because the Fund may invest its assets in underlying mutual funds or ETFs that have their own fees and expenses in addition to those charge directly by the Fund, the Fund may bear higher expenses than a Fund that invests directly in individual securities.