Bond duration is a diving board.

Don’t let clients fall in.

Don’t let clients fall in.

October 2025

Why gamble on where rates go next? Instead, position clients in a proven strategy with the potential to perform across various rate environments: the Rational Special Situations Income Fund (RFXIX).

Many professional money managers continue to increase exposure to longer duration bonds, some with explicit bets on falling interest rates. Bond duration works like a diving board:

Over the past five years, the Bloomberg Aggregate Bond Index (the “Agg”) has bounced up and down, but remains in negative territory.

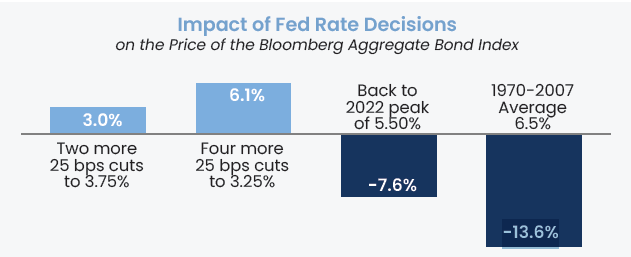

Even if the Fed cuts rates moderately, the Agg’s upside is relatively limited, and the subsequent yields may no longer be compelling for most clients. If rates rise again, downside risk could be significant.

Source: Rational Advisors, Inc. and Bloomberg LP. Data as of 30 September 2025. Agg is the Bloomberg Aggregate Bond TR Index (LBUSTRUU Index). Assumptions: Modified duration: 6.05; Effective convexity: 0.44; Yield to worst: 4.37%; Current federal funds rate upper bound: 4.25%; Sensitivity of Bloomberg Aggregate Bond Index change in yield relative to Federal Funds -13.6% Rate change in yield: 0.5x.

Source: Rational Advisors, Inc. and Bloomberg LP. Data as of 30 September 2025. Agg is the Bloomberg Aggregate Bond TR Index (LBUSTRUU Index). Assumptions: Modified duration: 6.05; Effective convexity: 0.44; Yield to worst: 4.37%; Current federal funds rate upper bound: 4.25%; Sensitivity of Bloomberg Aggregate Bond Index change in yield relative to Federal Funds Rate change in yield: 0.5x.

RFXIX: Seeking a Solution That Can Perform in Various Interest Rate Environments

While many traditional fixed income allocations have struggled over the past five years, structured credit, and specifically Rational Special Situations Income Fund (RFXIX), has delivered relatively strong returns with far less volatility when compared to the Agg. With a higher baseline yield, limited interest rate sensitivity, and mitigated credit risk, RFXIX helps advisors capture income without relying on Fed predictions. In addition, the fund has generated alpha through special situations opportunities in structured credit markets.

RFXIX has significantly outperformed over the past 5 years.

Performance Ending September 30, 2025

Annualized if greater than a year.

| Share Class | 1 Month | 3 Months | 6 Months | YTD | 1 Year | 3 Years Annualized | 5 Years Annualized | 10 Years Annualized | Since Inception Annualized |

| Class A | 0.81% | 1.11% | 1.63% | 3.41% | 4.77% | 6.39% | 4.26% | 6.06% | 11.48% |

| Class C | 0.75% | 0.92% | 1.26% | 2.86% | 3.95% | 5.60% | 3.49% | 5.27% | 10.65% |

| Class I | 0.46% | 1.57% | 5.15% | 5.15% | 6.59% | 3.50% | 3.70% | 6.31% | 12.25% |

| Class A w/Sales Load | -3.97% | -3.71% | -3.17% | -1.50% | -0.19% | 4.67% | 3.25% | 5.54% | 11.15% |

Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted above. Results shown reflect the expense waiver, without which the results could have been lower. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. A fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. To obtain the most recent month end performance information please call 800-253-0412 or visit www.RationalMF.com.

The performance shown prior to July 17, 2019 is that of the Predecessor Fund, which reflects all of the Predecessor Fund’s actual fees and expenses adjusted to include any fees of each share class.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

There is no assurance that the Fund will achieve its investment objectives. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. Performance shown before July 17, 2019 is for the Fund’s Predecessor Fund (ESM Fund I, L.P.); please refer to important disclosures set forth below.

Maximum sales charge for Class A is 4.75%. Maximum Deferred Sales Charge of 1.00% on Class C Shares applies to shares sold within 12 months of purchase. Net expense ratios for the fiscal year were 1.77%, 2.01%, and 2.77% for Class I, A, and C shares, respectively. The Total Annual Fund Operating Expenses are 1.83%, 2.08%, and 2.77% for Class I, A, and C shares, respectively. The Fund’s investment advisor, Rational Advisors, Inc. (the “Advisor”), has contractually agreed to waive all or a portion of its management fee and/or reimburse certain operating expenses of the Fund through April 30, 2026.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Rational Funds. This and other important information about the Fund are contained in the prospectus, which can be obtained by calling (800) 253-0412 or at www.RationalMF.com. The prospectus should be read carefully before investing. The Rational Funds are distributed by Northern Lights Distributors, LLC, member FINRA/SIPC. Neither Rational Advisors, Inc. nor ESM Management LLC is affiliated with Northern Lights Distributors, LLC.

Important Risk Information

Investing in the Fund carries certain risks. The value of the Fund may decrease in response to the activities and financial prospects of an individual security or group of securities in the Fund’s portfolio. Investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategies. The Fund is non-diversified and may invest a greater percentage of its assets in a particular issue and may own fewer securities than other mutual funds; the Fund is subject to concentration risk. When the Fund invests in asset-backed securities and mortgage-backed securities, the Fund is subject to the risk that, if the underlying borrowers fail to pay interest or repay principal, the assets backing these securities may not be sufficient to support payments on the securities. Interest rate risk is the risk that bond prices overall, including the prices of securities held by the Fund, will decline over short or even long periods of time due to rising interest rates. Bonds with longer maturities tend to be more sensitive to interest rates than bonds with shorter maturities. Lower-quality bonds, known as “high yield” or “junk” bonds, present greater risk than bonds of higher quality, including an increased risk of default. Credit risk is the risk that the issuer of a security will not be able to make principal and interest payments when due. These factors may affect the value of your investment.

The Fund commenced operations on July 17, 2019. The performance shown prior to July 17, 2019, is that of the Predecessor Fund (as defined herein), which reflects all of the Predecessor Fund’s actual fees and expenses (i.e., the Predecessor Fund’s annual management fees and operating expenses before any fee waivers and/or expense subsidies), as adjusted to include any applicable sales loads and distribution (12b-1) fees of each class of shares of the Fund. The performance of the Predecessor Fund has not been restated to include the other fees, estimated expenses and fee waivers and/or expense subsidies applicable to each class of shares of the Fund. The Fund’s fees and expenses are expected to be higher than those of the Predecessor Fund, so if the Fund’s expenses were applied to the Predecessor Fund’s performance, the performance would have been lower.

The Fund commenced operations by acquiring all of the assets and liabilities of ESM Fund I, L.P. (the “Predecessor Fund”) in a tax-free reorganization on July 17, 2019 (the “Reorganization”). In connection with the Reorganization, investors in the Predecessor Fund received Institutional Shares of the Fund. The Fund’s investment objectives, policies, guidelines and restrictions are, in all material respects, equivalent to those of the Predecessor Fund. However, the Predecessor Fund was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and, therefore, was not subject to certain investment restrictions, limitations and diversification requirements that are imposed by the 1940

Act or Subchapter M of the Internal Revenue Code of 1986, as amended, which, if they had been applicable, might have adversely affected the Predecessor Fund’s performance. The Fund’s Sub-Advisor was the investment adviser to the Predecessor Fund.

20251008-4879483